The megatrends of asset management

A total of 9,900 employees work in the asset management industry, one of the most important pillars of the Swiss financial centre. In 2018, Swiss asset management amounted to a total volume of CHF 2161 billion. The IFZ/AMP Asset Management Study, which was prepared by the Lucerne University of Applied Sciences and Arts and the Asset Management Platform Switzerland, underscores current trends.

There are a number of developments in the asset sectors: the global introduction of ESG standards requires financial planners to be certified according to internationally uniformly defined rules. This is why training (independent auditing procedures) and proof of experience (ethical standards) are becoming increasingly important for asset specialists.

With regard to asset management, one of the most important core businesses of Swiss banking, the situation nevertheless looks very promising.

Stability and specialist knowledge are still important prerequisites for mastering the investment trends of tomorrow. Regulated training in sustainability products alone is becoming increasingly relevant, because "financial advisors today need very in-depth knowledge in certain areas," says Prof. Tilmes, Academic Director Finance & Wealth Management at EBS Executive School, Oestrich-Winkel.

Swiss asset experts have also recognised this. Last but not least, the IFZ/AMP Asset Management Study published in November 2019 by the Lucerne University of Applied Sciences and Arts and the Asset Management Platform Switzerland highlights important developments: More investment money is indeed flowing into sustainable investments. Accordingly, asset advisors would have to balance out competencies in "green investments".

Key factors in asset management:

- Political and legal environment In particular, a stable and reliable political and legal environment and a strong education system with a qualified workforce are identified as key factors for success. Switzerland leads the current stability index with 82.8 out of a possible 100 points, ahead of Norway (82.5) and Singapore (81.1). At the other end of the scale is South Sudan (20.1), which together with six other African countries as well as Haiti, Yemen and Syria forms the group of the ten most unstable countries.

- – Regulations as a challenge The survey shows that regulation is seen as the greatest challenge. About 70 percent of respondents believe that the relationship between regulatory costs and regulatory benefits is unbalanced. A majority of the asset management firms surveyed consider the costs of regulation to be high. Asset managers in Switzerland see potential for regulatory improvements, particularly through the abolition of stamp duty and a reduction in withholding tax.

Dynamic real economy

"Asset management companies based in Switzerland play an important financial role by channeling savings into the real economy. In doing so, they create jobs and strengthen the economy," says Lorenz Arnet, CEO of the Asset Management Platform Switzerland. According to this study, the total volume in the asset sector at the end of 2018 was CHF 2161 billion, three times Switzerland's GDP and around twice the assets of Swiss pension funds.

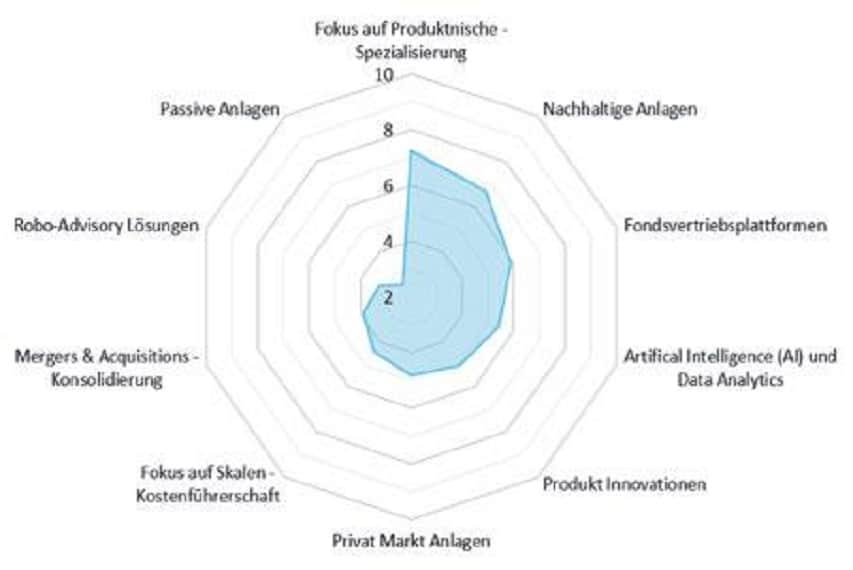

- – Great potential for sustainable investments To gain a competitive advantage in the asset management industry, it is important to choose a business model that focuses on either cost leadership or product specialization. The survey results show "that asset managers based in Switzerland tend to focus on specialization with clearly defined core competencies," says Jürg Fausch, co-author of the study and an economist at the Lucerne University of Applied Sciences and Arts.

Active management dominates

Around 70 percent of the assets managed in Switzerland are managed actively and 30 percent passively. In the case of discretionary management mandates, around two-thirds of the assets are actively managed.

These figures confirm the findings of the sentiment analysis that Swiss-based asset managers are focusing on specialized, actively managed products to gain a competitive advantage. In addition, asset managers in Switzerland are heavily involved in alternative asset classes, most of which follow active portfolio management strategies.