The European plastics industry under the spell of price increases and stagnation

From October 19 to 26, 2022, the world's largest plastics trade fair "K" will take place in Düsseldorf. Meanwhile, the European plastics industry must prepare for increasing instability, higher prices and lower growth.

The European plastics industry is facing challenges on a number of fronts. This will also be noticeable at this year's K, probably the most important information and business platform for the global plastics and rubber industry. The plastics trade fair will be held in Düsseldorf from October 19 to 26, 2022, and is regarded as a showcase for all plastics processing industries.

In packaging, by far the plastics industry's largest market, it has become a victim of its own success as a supplier of the ideal material for disposable applications and people on the move. In construction, some infrastructure projects may be put on hold as governments divert some funding from infrastructure projects to defense, although business is boosted by consumers receiving assistance to improve the energy efficiency of their homes. In the automotive sector, suppliers are suffering from production cuts by automakers - not in response to declining demand, but because they can't get the chips they need for their electronics.

High energy prices weigh on the European plastics industry

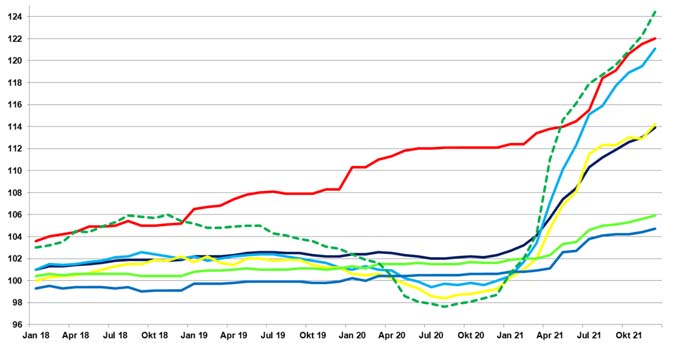

Since the beginning of 2019, COVID-19 has had a major impact on production, occasionally positive, but mostly negative. And now, as Europe and the rest of the world are in the process of recovering from the devastating two years of the pandemic, there is the added tragedy of the Ukraine conflict. Commenting on the situation at the end of March 2022, Martin Wiesweg, executive director polymers EMEA at consultancy IHS Markit, said the crisis was not only causing a humanitarian catastrophe but was also weighing heavily on the plastics industry, driving up costs, exacerbating supply chain bottlenecks, including energy supply, and raising the specter of a demand shock as global stagflation is feared. "High crude oil prices have had a negative impact on European plastics demand in the past (see chart)," Wiesweg said. If prices continue to rise, consumer disposable income could plummet, which would impact retail sales. Segments dependent on consumer spending that are not essential, such as home appliances, consumer goods and cars, would fare poorly as shoppers try to save money. "In the short to medium term, Europe could see a decline in demand for polymers."

Germany remains the "powerhouse" of the European plastics industry with its diverse strengths in materials, equipment and processing capabilities. But some sectors are nevertheless struggling. According to the GKV (Gesamtverband Kunststoffverarbeitende Industrie), the industry's sales increased by 12.6 % to 69.4 billion euros in 2021, but member companies continue to face severe pressure on earnings. In this regard, the association points to an "exorbitant cost explosion" for raw materials and energy, as well as the many delivery delays and resulting order stoppages, especially in automotive supply.

Alarm bells are ringing at Unionplast, the association of Italian plastics processing companies, because of energy prices. "The crisis in energy prices is having a serious impact on an industry with over 5,000 companies and more than 100,000 employees," says Marco Bergaglio, president of the association. "The uncontrolled rise in energy costs and the increasing difficulties in sourcing raw materials are a lethal mix for our industry and pose the risk that we may actually be unable to meet our customers' requirements. This situation inevitably has an impact on the prices of our products."

European machinery manufacturers in good shape

Things are looking better for European plastics machinery manufacturers. Thorsten Kühmann, Secretary General of EUROMAP, the European association of plastics and rubber machinery manufacturers, stated in March that the order books of member companies "are filled to the brim. The current year will therefore be another very good one. We expect sales to increase by 5 to 10 %." However, rising prices and now the war in Ukraine are also causing uncertainty here. Dario Previero, president of Amaplast, the association of Italian manufacturers of plastics and rubber machinery and molds, predicted at the end of last year, "According to our estimates, production at the end of 2021 should be within a hair's breadth of pre-pandemic levels, increasing by 11.5 % compared to 2020. The significant recovery in 2021 leads us to expect output in 2022 to be above pre-crisis levels."

Ulrich Reifenhäuser, CSO of the Reifenhäuser Group, a leading manufacturer of extrusion lines, and also Chairman of the K Exhibitor Advisory Board, speaks of an "exceptionally positive" order backlog for the current year. "The extremely high demand for our meltblown nonwovens lines, which have played a decisive role in ensuring that sufficient medical protective masks can be produced worldwide to combat the pandemic - especially in Europe with local production capacities, has contributed significantly to this." Gerd Liebig, CEO of Sumitomo (SHI) Demag, a major injection molding manufacturer, also says that overall consumption figures are good. "Nevertheless, the coronavirus situation has had a significant impact on demand. However, we expect a quick recovery due to our strong business strategy." For this company, machine sales are also on track to exceed pre-pandemic levels. "Demand for all-electric models continues to grow, and we expect this share to increase further," Liebig said. And at Arburg, Gerhard Böhm, managing director of sales and service, reports, "We sold more machines in 2021 than ever before - and we also have a good order intake this year." But he also points out that material prices and delivery times are a concern. "It's clear that supply shortages are preventing our customers from investing in some cases, but the demand is certainly there," he says.

Packaging challenges

The European plastics industry has to deal with various pieces of legislation on plastic waste on an ongoing basis. For example, there is a requirement for 55 % of all plastic packaging in the EU to be recyclable by 2030, as well as a levy on non-recycled plastic packaging waste. Some countries are also introducing local legislation (e.g. Spain and France), so the playing field is not as level as it should be.

The industry is already having to live with the consequences of the SEA Directive, some elements of which came into force in most EU countries on July 3, 2021 - although the introduction of the legislation has not been entirely smooth. In Italy, for example, it only came into force in January, so final implementation was delayed. In addition, the definitions of plastic products are more flexible than Brussels originally intended, because while the SEA Directive does not exclude certain biodegradable plastics, the Italian legislation does.

On the subject of bioplastics, the trade association European Bioplastics says: "Unfortunately, bioplastics still do not receive as much support in Europe as other innovative industries do from EU policymakers. The EU Commission has partly contradictory positions on bioplastics. The positions of the member states on bioplastics also vary widely, and the regulatory environment is anything but harmonized. This discourages investment in research and development and in production capacities," it says.

Despite these challenges, the development of European bioplastics is "very positive. Global production capacity still accounts for less than 1 % of the more than 367 million metric tons of all plastics, but by 2026, bioplastics production will exceed 2 % for the first time." Production capacity for bioplastics in Europe was just under 600,000 metric tons in 2021 and is expected to increase to around 1,000,000 metric tons over the next five years.

Recycling on the rise

"New laws and targets for recycling plastics and using recyclate are changing the way the whole plastics industry has to operate," says Elizabeth Carroll, a recycling and sustainability consultant at AMI Consulting in Bristol, U.K., the consulting firm that released a new report on mechanical recycling in Europe. "As a result, the mechanical plastics recycling industry has become a focal point for investment, acquisition and expansion," she says.

In 2021, the production of recycled plastics in Europe totaled 8.2 million tons and is projected to increase by 5.6 % per year through 2030. This compares to 35.6 million tons of standard plastics that entered the waste stream in 2021. "This means that Europe as a whole has reached a plastics recycling rate of 23.1 %," Carroll says. This figure will most likely increase as the plastics industry makes extensive investments in various recycling technologies.

Sometimes, however, it is an uphill battle as Guido Frohnhaus, Managing Director of Technology & Engineering at Arburg, admits: "As long as recyclates are more expensive than virgin materials, the question arises for every medium-sized company as to why they should use them at the expense of their own profitability. Politicians must set clear legal requirements here, and the EU must not only ban individual plastic products, but also consistently support the circular economy."

Fortunately, recycling technology is making great strides in Europe. Austrian companies such as Erema and Starlinger, for example, are among the leaders in this field, while Amut and Bandera are among the Italian extrusion specialists developing systems for treating film waste. PET bottle technologies specialists Sipa, in collaboration with Erema, have developed the first fully integrated system for recycling post-consumer flakes into bottles for food contact applications. Automated sorting technologies for mixed PCR are also making great strides, with Norwegian company Tomra playing an important role.

Polymer suppliers for the European plastics industry go green

European polymer producers are making great efforts to improve the sustainability of their products. Richard Roudeix, Senior Vice President - Olefins & Polyolefins Europe, Middle East, Africa and India at LyondellBasell, one of the largest producers of polyolefins and compounds, explains, "To become carbon neutral by 2050, the industry will need to make a profound change in a relatively short time, especially considering that some technologies to fully decarbonize our processes are still in early stages of development. Currently, high energy costs are squeezing industry profits at the very time the industry needs additional funding to invest in decarbonization."

Polymer suppliers don't quite see eye-to-eye with European policymakers on the transition to a green economy, but opinions are converging. "LyondellBasell believes that alternative government policies and voluntary measures are more effective than pursuing environmental goals through national taxes alone," Roudeix says. He suggests using a fee based on the recyclability of the product to fund infrastructure improvements and plastic recycling programs. LyondellBasell has set a goal of producing and marketing two million tons of recycled and renewable polymers annually by 2030. The company has already launched plastics made from mechanically and chemically recycled plastic waste and bio-based raw materials.

SABIC made similar comments. The company launched certified recycled polymers in 2019, which are produced by upcycling end-of-life plastics. "In fact, however, the demand for recycled plastics is currently greater than the supply," said a representative, adding, "Manufacturers need to find a way to expand supply to bring about real change." According to SABIC, greater regulatory support from governments is needed to help industry players scale up new techniques such as chemical recycling. "For example, it's important that the European regulatory framework recognizes chemically recycled resin as equivalent to virgin resin produced from fossil fuels to increase availability and promote scalability." And at BASF, which like SABIC offers a wide range of plastics for different markets, a representative says, "We expect plastics to play an important role in achieving the EU's net-zero emissions targets by contributing to emissions savings in key sectors such as construction, automotive and food packaging. Globally, we aim to achieve net zero CO2 emissions. We also aim to reduce our greenhouse gas emissions globally by 25 % by 2030 compared to 2018."

Source and further information: www.k-online.de