Switching to SAP S/4HANA: It takes the right partner

In management circles, the topic of ERP projects does not always have a positive connotation. Studies show that ERP implementation projects usually cost more than planned, take longer and do not achieve the expected results in the end. The same applies to major release upgrades. Especially in manufacturing SMEs, the motto "never change a running system" often applies. But at the latest, when the mainstream maintenance of SAP Business Suite expires in 2027 as announced, there is hardly any way around the migration to SAP S/4HANA for SAP customers.

In 2015, with the product launch of SAP S/4HANA, the successor product to Business Suite, SAP announced a solution with which customers can drive digital transformation with the simplicity of the cloud. Here, the "S" in the name stands for "Simple" and the "4" for the fourth product generation. "HANA" indicates that the solution runs entirely on the SAP HANA in-memory database. According to SAP, just 8 months after the official product launch, more than 30 customers were live with SAP S/4HANA and more than 417 active projects were communicated (Source: https://it-onlinemagazin.de/wp-content/uploads/2016/01/S4HANA_SAP_HANA_S4_Grundlagen_2016.pdfpage 3). Many customers who were using the Business Suite productively at the time did not really take the announcement seriously at the time, since according to the roadmap they still had a commitment from SAP to maintain and further develop their solution until the end of 2025.

Although SAP launched a series of campaigns in the years that followed, which promoted a timely migration to SAP S/4HANA, those responsible in many user companies did not initially decide to make the switch, or rather saw it in the distant future. We can only speculate about the reasons for these decisions. The cost/benefit aspect certainly played a significant role in the considerations.

Sluggish readiness to migrate

ERP implementation projects usually cost more than planned, take longer and do not achieve the expected results in the end. The strategy of initially deciding against a migration "of the first hour" is also perfectly understandable for factual reasons. Software products are never error-free, and this is especially true for complex applications such as ERP solutions. Companies that decide to use a standard application with a small number of productive users should therefore factor in a higher cost for support, both external and internal.

Another relevant aspect of deciding against an early SAP S/4HANA migration was certainly the lack of availability of implementation consultants with relevant practical experience. The established system houses and implementation partners had only a few SAP S/4HANA projects of their own at the time. The opportunity to deploy their consultants in corresponding projects was therefore limited. In addition, training implementation consultants in new software versions is usually difficult anyway, as their availability is usually limited due to their high workload.

What is the current market situation today, almost 8 years after the product announcement by SAP with regard to S/4HANA? This was one of the topics addressed by the DSAG (German-speaking SAP® Anwendergruppe e.V.), which is why it surveyed its member companies for its annual investment report. For the 2022 report, the question "How far along is your company or organization in terms of implementing S/4HANA?" was answered as follows (see Figure 1). 12 % of respondents had not yet decided and 6 % did not want to switch to S/4HANA. Those who did not want to switch cited "uncertainty about functionality" and "lack of business case" as reasons, among others. 47 % of respondents said they were planning to migrate but had not yet started. 23 % of the companies were in the process of implementing the solution and only 12 % already had S/4HANA in use.

In the 2019 investment report, four years after product announcement, only 3 % of DSAG members had already migrated to S/4HANA and 30 % were planning to migrate in three years at the earliest. Because of this sluggish migration readiness, DSAG lobbied SAP for resilient release and maintenance planning beyond 2025 for its members. In response, SAP extended Business Suite maintenance and development by two years in February 2020. The so-called "mainstream maintenance" now runs until the end of 2027 without additional fees. Those who need even more time for the changeover to S/4HANA can take advantage of the additional chargeable maintenance offer "Extended Maintenance" for the Business Suite until the end of 2030. This is associated with a surcharge of two percentage points on the existing maintenance base, i.e. an increase from 22 to 24 %. In a statement on the maintenance extension by SAP, DSAG board member Andreas Oczko recommended in February 2020 that the time gained be used immediately: "The maintenance commitments for Business Suite 7 until the end of 2030 are not a carte blanche to continue waiting. On the contrary, it must be the starting signal for companies to put aside their last restraint and begin the digital transformation."

Ways for a successful transformation

SAP customers who have not yet started the transformation project (approx. 60 %) have various technical and conceptual options for migration at their disposal. With regard to the migration approach, a distinction is made between brownfield, greenfield and a middle way, so-called selective migration.

The brownfield approach follows the concept of a step-by-step conversion and changeover of the existing system in the direction of S/4HANA. The implemented solution remains almost unchanged, but receives a kind of upgrade. Individual customizations are largely retained and existing data is essentially continued to be used. For technical support of the migration, SAP provides solutions such as the Software Update Manager (SUM) or the Database Migration Option (DMO), among others. The advantages of the brownfield approach are the possible retention of individual processes and integration into the existing system landscape with simultaneous modernization, standardization and consolidation of the overall system.

In the style of "building something on a greenfield site" without taking existing or evolved constraints into account, the greenfield approach corresponds to a fundamental new implementation of the SAP S/4HANA solution. The greenfield approach is similar to switching from another ERP product to SAP S/4HANA. In both cases, a completely new instance of SAP S/4HANA is set up by analyzing and redesigning current business processes to map them as closely as possible to the standard within the new software. The existing master data of the existing SAP or non-SAP solutions is migrated step-by-step into the new system by means of appropriate adjustments and conversions. As a rule, transactional or historical data is not migrated in its entirety, as the effort required for the transformation may be considerable. The greenfield approach offers companies the advantage that ERP systems that have been individualized over the years are replaced by a new standard version of SAP S/4HANA and that business processes are optimized in parallel with the SAP implementation. However, a prerequisite for this is the willingness to implement comprehensive process and, if necessary, structural organizational changes as part of the implementation. Methodologically, the implementation of the necessary organizational measures should be underpinned by appropriate change management.

Selective migration or landscape transformation represents a middle ground between greenfield and brownfield. Experts also refer to this as the color field approach or a hybrid strategy. Selective migration is an approach based on brownfield. If companies take such a path, the current productive system is first copied, then all existing transaction-based data is deleted. The system is then migrated to SAP S/4HANA. If necessary, required adjustments and configurations are made. Subsequently, data is selectively mi-grated from the current productive system. As part of this approach, it is necessary to control the data transfer individually, for example, by transferring or recoding only a defined section of data. This increases the complexity of the already complicated data migration. A version of this approach was developed by SNP Schneider-Neureither and IBM Services and is marketed under the name Bluefield. With the CrystalBridge platform, SNP provides a corresponding tool for data transfer as part of an SAP S/4HANA migration. Various SAP system houses are qualified as partners with SNP and use SNP's platform as part of their projects.

Which type of migration, brownfield, greenfield or bluefield, makes the most sense for a company depends on various criteria. In addition to the strategic objective of the project, the objective of the migration project (e.g., process optimization, process harmonization, "back to standard," improvement of data/information quality), the following aspects play a role, among others:

- Readiness of the company for organizational change

- Degree of automation of business processes

- Available project budget

- Restriction regarding the project duration

- Configuration of the current productive system

- Number and scope of individual adjustments

- Requirements regarding the availability of historical data

- Operating model (public cloud, private cloud or on-premise)

- Number and scope of interfaces to other applications

- Know-how of the project managers in the company

- Methodological competence of the implementation service provider

Operating models: Examine various options

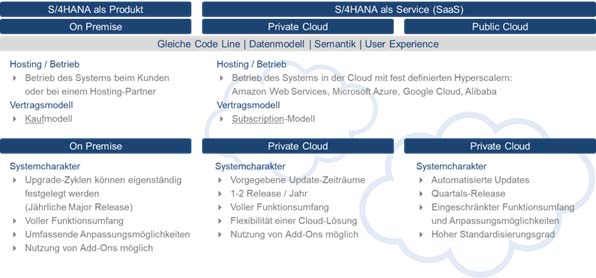

Companies also have several options in terms of operating model, licensing and deployment (see Figure 2). In general, there is the option of licensing the solution on-premise (classic purchase model) or as SaaS (subscription or rental model). SAP bundles the latter in RISE. "RISE with SAP" is an offering package designed to help companies switch to SAP S/4HANA in order to develop and optimize business processes in the cloud. As a contractual partner, SAP takes care of all the necessary steps, such as analysis, operation, support, and the selection of and negotiations with suitable hyperscalers. In order to advise customers on the selection of the operating model, the required scope of services and the associated costs, SAP offers corresponding analyses in the form of questionnaire-based workshops (e.g. the so-called "Readiness Check" or "Process Discovery"). As a rule, these are free of charge and a prerequisite for the provision of a corresponding offer for SAP S/4HANA use.

As already mentioned, there are many examples that prove that ERP projects always turn out to be more expensive than calculated and take longer than planned. However, it is worth taking a closer look. There is a well-known quote that every project manager should know: "Tell me how your project starts and I'll tell you how it ends". In many cases, one main cost driver for inadequate project implementation is ignored at the very beginning: Choosing the right sourcing strategy! Especially in the case of SAP S4/HANA migrations, people often reflexively consider only the current SAP system house and negligently omit a systematic selection of the optimal SAP service provider. Yet the market for potential implementation partners is large and heterogeneous. A sufficient number of system houses have a great deal of experience, often decades of cooperation with SAP, various partner roles and different partner statuses or certification levels according to the SAP PartnerEdge program.

The PartnerEdge program distinguishes between four levels. With the SAP PartnerEdge Open Ecosystem partner level, SAP aims to reduce the barrier to entry into the organized partner landscape. No fees are charged for the program and, apart from a few product-specific training courses, no proof is required. The next two levels, Silver and Gold Partners, are designated as "Committed Partners". Here, both program fees are due and the verification requirements are significantly increased. The partners must have comprehensively trained personnel, coordinate a business plan with SAP and, if necessary, have their solutions certified. Advancement from silver to gold partner is governed by a points system. The partner receives the so-called value points for certain activities (e.g. sale of a solution, additional training of personnel, new references, certification of a solution or services, etc.). In addition, partners at these levels can participate in the "SAP Recognized Expertise Program". The program is used to mark a partner's special expertise in one of 21 industries or one of 30 solutions. For certification, partners must prove their competencies through appropriate references, projects, and specific training of their employees. In addition, SAP requires partners to submit a specific business plan for the industry or solution, the implementation of which is reviewed by SAP. The highest level, Platinum Partner, is reserved for long-term strategic partnerships. These partners currently include large technology groups such as IBM and Deutsche Telekom, as well as internationally positioned sales partners such as NTT DATA and large system integrators such as ATOS and Capgemini.

An initial orientation of the SAP partner market is provided by the "Partner Finder" on the SAP homepage (https://www.sap.com/germany/partners/find.html). Filter options can be used to select the companies listed in the SAP Partner Program. A search for partners offering "Project Services" for the solutions "ERP and SAP S/4HANA" yields a hit list of more than 1,550 companies worldwide. For the German market, there are still just over 230 system integrators. An additional filter can be used to further narrow down the list of partners to a so-called "focus industry". For example, for "industrial manufacturing" the list of providers can be reduced to around 160, for the "retail" sector there are just over 130 and for "life sciences" around 100.

As part of a well-founded and competitive sourcing strategy for an SAP S/4HANA migration, the client should evaluate the potentially best service provider before the actual start of the project, develop a secure contractual agreement and, last but not least, build a good starting point for the upcoming commercial negotiations. In Trovarit's view, a professional SAP system house selection and project award should successively reduce the bidder environment and provide well-founded, easily comparable information from the potential SAP partners. In this context, questions such as:

- Which SAP S/4HANA certifications does the partner have? How many comparable migrations has the service provider already performed in the S/4HANA environment?

- Which project approach (greenfield, brownfield, or color field) does the migration partner recommend?

- How is the project-specific implementation methodology characterized and with which tools and templates (so-called tool chain) does the service provider usually work?

- Which operating model (public cloud, private cloud or on-premise) is recommended by the service provider?

Cooperation with partners: What it can look like in practice

Figure 3 shows Trovarit's standard procedure. In the first module "Start-up", the project is first defined together with the client. For example, the objectives, the project schedule, the project documentation and the project controlling are agreed upon. In the subsequent "Project Request" module, a so-called project profile is compiled with all the relevant information for an RFI (Request for Information) and the distribution list and contents of the request are defined. The project request is sent online to the potential system houses via IT-Matchmaker. By means of the so-called project chat, the participants in the inquiry have the opportunity to ask the client further qualifying questions. This digital, context-related dialog can be used to efficiently clarify ambiguities in the documents sent. If necessary, the corresponding contents of the chat history can be made available to all requested providers at the push of a button. Based on the responses of the requested system houses, the favored companies (TOP 3) are determined for the subsequent tender.

Parallel to the project inquiry, the project scope is roughly agreed or defined within the scope of a "fit gap" analysis. For sourcing in the SAP environment, it has proven useful to use the list of scope items provided by SAP. The specification of whether or not these approximately 700 items are required in the scope of services for the S/4HANA migration provides a good initial indicator of the project complexity. When evaluating the scope items, it is also advisable to include so-called focus topics in parallel to selected processes/tasks and to specify them in bullet points. In preparation for the subsequent pre-selection, it is necessary to create a tender and award document. Among other things, this document outlines the entire award process, describes what is expected of the service provider, sets out the requirements for the project methodology, and specifies the form of contract desired by the client. As part of the RFQ (Request for Quotation), the favored implementation partners are also provided with the previously recorded project scope (evaluated scope items) as well as the task definitions with regard to the recorded focus topics.

In parallel with the RFP, vendors will be invited to participate in two to three day workshops. In preparation for the workshop, they will receive a script that includes the agenda, expectations for the process, and task/question statements for that date. Based on the previous preparatory work, solutions to the focus topics are expected, the presentation of the project methodology is covered, a recommendation for the project approach (Bownfield, Greenfield and Bluefield) and the operating model are requested. Interviews with the designated project manager and solution architect are conducted to get to know the key people involved in the project, and selected reference customers are interviewed by phone, if applicable. The result of the tender and final selection is a final overall evaluation. Thanks to the structured approach, all the available information can be compared very well and condensed into an overall value for each provider and system. As part of the overall evaluation, all relevant evaluation aspects should be taken into account and compared with the cost information provided by the suppliers.

The final step is the contract negotiation/formulation with the "TOP provider". In addition to the legal and commercial aspects, it is essential for the contractual agreement to define the responsibilities for all relevant project tasks in a so-called RACI matrix. For this, Trovarit uses its own template stored in IT-Matchmaker with approx. 400 project activities. A module contract has proven to be the best form of contract for SAP S/4HANA migrations. All cross-phase topics are defined via a framework contract. With the completion of a project phase, the scope of services and the results to be delivered for the next project phases are defined and bindingly agreed in a corresponding individual contract.

Author:

Peter Treutlein is a member of the Executive Board of the consulting firm Trovarit AG in Aachen. www.trovarit.com