Swiss private banks under scrutiny

Are more Swiss private banks disappearing from the scene? The private banks are in a better position than they were two years ago, as a study by the consulting firm KPMG points out. But only part of the industry has reason to be optimistic about the future given the current structural changes.

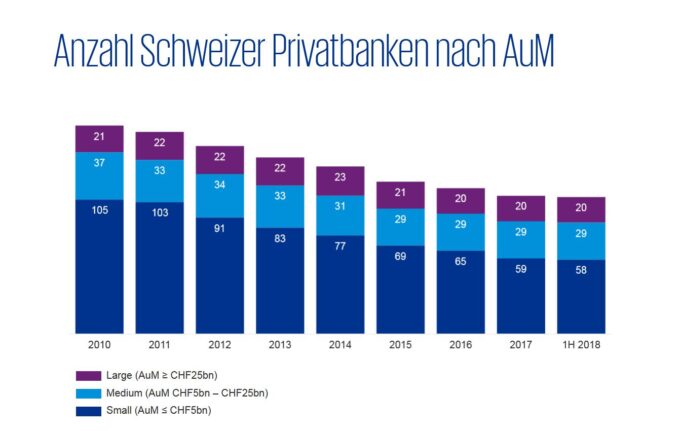

The situation no longer seems rosy for Swiss private banks either. As experts from the consulting firm KPMG already showed five years ago, the private banking industry is stalling. Since 2013, almost a third of well-known players have disappeared from the scene (see the KPMG study below). The KPMG experts are critical of the situation.

Philipp Rickert and Christian Hintermann from the financial services team of the consulting firm KPMG informed journalists about the dwindling number of the current 107 institutions on the occasion of a newly published performance study of Swiss private banks. Their forecast: "They will shrink to 70 or even 60 percent" of the current amount in the next few years.

At least 23 banks in the red

"The individual positioning of the private banks we surveyed is brutal," Rickert soberly commented on available study statistics. Rickert referred to differences of 20 and more percent between the individual banks in important development ratios. The consultants underpinned their forecast with a presentation of the development of the "cost-income ratio" (CIR) for the 90 private banks surveyed in the study.

Of the 90 institutions examined by KPMG, 23 banks are in the "weak performers" category based on the CIR criteria and the return on equity. 31 banks were in the "lower mid performers" category. The KPMG consultants believe that overly diversified private banks, which are already competing against large global players, will not survive.

Some of the mid-performers also failed to make it if they did not focus on core businesses. The consultants based their forecast on a series of figures compiled over a longer period of time.

Only very few banks have shown positive developments in recent years. Some small private banks would continue to tread water in the red, showing very weak profitability below one percent of annual earnings. Hintermann was very pessimistic about weaker performers at the press conference.

Private Banking extremely competitive

Overall - the study concludes - Swiss Private Banking is currently in a better position than it has been for ten years. One key figure illustrates this: The cumulative net profit of the banks surveyed - UBS and Credit Suisse are not subject to the KPMG study - smoothly doubled between 2015 and 2017 to CHF 2.8 billion.

However, the "best" private banks would also generate the largest turnover. The KPMG experts made some interesting comparisons. For example, that many medium-sized private banks are stuck with assets under management of between CHF 5 and 25 billion. Among the "weak performers" were four large (over CHF 25 billion), four medium-sized and 15 small banks.

The "low mid performers" included eight large, six medium-sized and twelve small institutions. The good and very good performers, on the other hand, are six large, 14 medium-sized and 21 small private banks. The names of the banks remain secret. The KPMP experts criticized small banks for having business models that were too "bogged down".

Will the already solid institutions among the Swiss private banks now dominate the market? More details in the KPMG study "Clarity on Performance of Swiss Private Banks and in the coming December issue of Management & Quality (MQ-2018-12).