Roles and competence profiles of the compliance officer

Today, it is impossible to imagine many companies without the compliance officer. However, his role is a complex one: Increasing regulation, multi-layered and complex tasks to ensure compliance with standards, increased exposure due to growing awareness among the public and the media, as well as criminal and civil liability risks that can no longer be neglected outline a comprehensive field of work.

The results of the study of the profession conducted by the Lucerne University of Applied Sciences and Arts make it clear that the professional field of compliance has become further established. In addition, organisational establishment, training and continuing education activities show that compliance officers seem to have largely found their position and role within the corporate organisation. An important indication of this is certainly the hierarchical arrangement of a compliance department at the upper levels of the hierarchy. This is also one of the basic prerequisites for being able to develop a necessary compliance culture and implement compliance measures throughout the company. Coupled with the expected increase in the importance of compliance within and outside the organization, this results in a solid foundation for a compliance officer to continue to fulfill the tasks assigned to him in the future.

However, the study also reveals a number of challenges that compliance officers will have to overcome in the future in order to maintain their position within the organization in the long term. Central here is above all the question of his strategic role. Here, the compliance officer does not yet seem to have sustainably communicated his opportunities to make an undeniably important contribution to the company's development.

What are the tasks and competence requirements for compliance officers?

Almost every day, compliance officers conduct consultations in the company on the topic of compliance. This primarily involves providing information about regulatory requirements and discussing their practical implementation. Other key tasks include monitoring and controlling compliance with regulatory requirements and compliance documentation. Proper documentation is the core element of a good compliance system and facilitates management and control as well as reporting and evidence. In addition, compliance risks must be regularly identified, analyzed and assessed. Less frequently, however, internal training and investigations are carried out or internal compliance regulations and directives are established. Only rarely is a whistleblowing system operated, such as a whistleblowing hotline or an ombudsman's office, to enable employees or third parties to report misconduct and illegal or unethical behavior within the company.

With regard to the necessary qualifications, compliance officers rate personal competencies as more important than technical and methodological competencies. In terms of professional and methodological competencies, knowledge of the legal requirements for compliance and knowledge of compliance methods for the general establishment and maintenance of a compliance management system are particularly relevant. Likewise, decision-making ability, structured thinking and solution-oriented action are considered very important. Auditing experience, forensic knowledge and numerical understanding are seen as less important. Personal skills are dominated by integrity, followed by a sense of responsibility, reliability and discretion. Communication skills, assertiveness and the ability to deal with conflict are also rated as valuable; empathy and flexibility, on the other hand, are considered to be of little importance.

What are the roles of compliance officers?

Based on a content analysis of job advertisements, various roles of compliance managers were developed (see Figure 1). Both rather broad roles can be defined, such as those of advisor and supporter or contact person and technical expert, as well as narrowly defined roles, such as those of implementer, conceptionist or supervisor. The various roles reflect the diversity of the understanding of compliance in corporate practice, which ranges from a rather narrowly defined compliance management focused on the avoidance of legal violations to a compliance management that creates added value.

A subsequent survey showed that compliance officers can identify with all of the role models mentioned here, but more strongly with the more broadly defined roles. This self-image shows that compliance officers tend to interpret their role broadly, with a focus on supporting and securing the company's success. In addition, compliance officers were asked to assess how they believe their role is perceived within the company. The presumed external image is dominated by rather negative images, such as the supervisor or regulator. This reveals a discrepancy between the self-image and the suggested external image. A large proportion even see a need for action to overcome this discrepancy. In particular, the compliance culture should be promoted, which can be achieved on the one hand through open communication and proximity to the respective units. Compliance controls must be perceived as protection for employees; this can increase acceptance. On the other hand, management and the board of directors should set an example of compliance. They must send positive signals and demonstrate the relevance of compliance. In this way, the compliance officer can be perceived at all levels of the company as a partner who is willing and able to provide support within the appropriate framework.

Finally, the compliance officers were asked about their satisfaction. Overall, the compliance officers are satisfied with their role, even if they only partially feel that they meet the requirements and expectations placed on them. Above all, they are expected to be able to communicate complex topics in an addressee-oriented and comprehensible manner and to always be available as a contact person for questions relating to compliance. They are not necessarily expected to recognize and identify compliance violations immediately.

Quo vadis Compliance Officer?

Finally, respondents were asked what specific changes can be expected in the function of the compliance officer over the next ten years. Above all, the increasing degree of automation and the increasing networking of data were mentioned. Data-based work will increase and artificial intelligence will help to identify and apply patterns and rules. Interpersonal relationships will continue to be of great importance, if not become even more relevant. A significant increase in regulations and tightening will further increase the complexity of compliance.

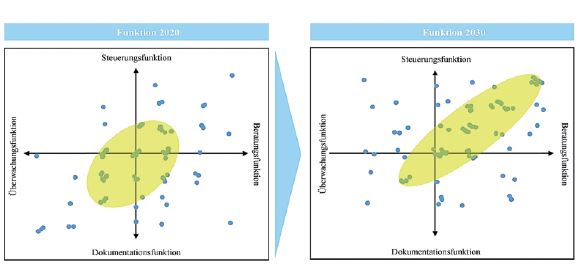

The requirements for compliance officers will continue to increase due to changing business models as well as changes in the regulatory and technical environment, making the activities more granular. This calls for a higher degree of specialization and increased skills in the analytical area to identify systematic problem areas through the application of data analytics. It is expected that the role of the compliance officer will increasingly change over the next ten years to that of a compliance advisor to management and department heads (see Figure 2).