Mobile payments: Transactions have tripled

For a long time, mobile payment was a niche product in Switzerland. That has changed. In the meantime, 40 percent of the population is already registered with the currently most widely used provider. The number of transactions has also tripled compared to the previous year. However, there are still regional and gender-specific differences in usage.

At the checkout, among friends, when paying the parking meter or in the online shop: Mobile payment via smartphone and payment app is becoming increasingly popular. The most widely used provider Twint reported over ten million transactions in September 2020. Compared to the previous year, the number of transactions increased almost threefold. This is shown by the Mobile Payment Study Switzerland 2020 of the Lucerne University of Applied Sciences and Arts. Study author Andreas Dietrich is convinced: "Mobile payment has now reached the population at large and is likely to become increasingly important in the future.

Used differently by region and gender

Impressive growth figures continue to be seen in the mobile payment market. At the time of publication of this study, Twint already has over three million registered users. Accordingly, over 40 percent of the Swiss population over the age of 15 have already registered with Twint. In terms of customer structure, it can be seen that mobile payments are currently still used slightly more by men. "This is a typical phenomenon of adoption behaviour with technological innovations," says Dietrich. With increasing market maturity, however, one can observe how the proportion of female users is also increasing. In the meantime, 45 percent of all mobile payment users are female. Two years earlier, the figure was still 36 percent.

Regional differences can also be observed. For example, in seven cantons more than half of the population over the age of 15 are already registered Twint users (FR, ZG, AI, VD, SG, OW and LU). However, there are also cantons in which less than 30 percent are still users of the Twint mobile payment solution (BL, GL, BS and AR). In all cantons, however, at least one in five is a registered user.

Stationary trade already accounts for one third of transactions

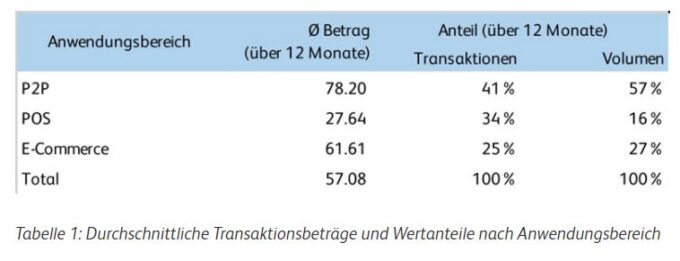

In terms of the number of transactions, Twint is dominated by the use cases peer-to-peer (P2P) - paying back money to friends, family, etc. - and point-of-sale (POS). Over the past twelve months, 41 percent of Twint transactions were made in the P2P space and 34 percent were made at the POS. A quarter of all transactions can be attributed to e-commerce and m-commerce (see Table 1). The average amounts vary greatly depending on the use case. While transactions amounting to CHF 28 on average are carried out at the POS, these are significantly higher in the area of peer-to-peer transfers (CHF 78) and in the area of e-commerce (CHF 62).

Lockdown effect with mobile payments?

Social life and the behaviour of individuals has inevitably changed as a result of the coronavirus pandemic. This situation also has noticeable consequences for the financial industry. But what consequences does this have for digital offerings and channels in the financial industry?

The figures show that the impact of Covid-19 was also noticeable for Twint in the first two months after the lockdown. The number of newly registered customers in particular increased sharply during this period.

In September 2020, a total of ten million transactions with a volume of over CHF 551 million were made via Twint. In February, before the Covid-19 measures, there were 5.3 million transactions with a volume of CHF 291 million. In March 2020, there was a volume of 333 million francs with 5.3 million transactions. Monthly Swiss franc turnover across all Twint application areas was thus up 89 percent in September compared to February.

In terms of the number of transactions, all areas were below trend immediately after the lockdown. However, it should be noted that trend growth was high, especially in e-commerce. The number of transactions doubled roughly every six months.

Overall, it appears that the growth noted this year is not due to the lockdown, but rather a sustained change in people's payment behavior can be observed.

228 million transactions expected for 2021

"The number of transactions by all providers will continue to increase in the near future," Andreas Dietrich is convinced. He assumes that by September 2022, around 30 million transactions per month will be made via mobile payment. This would result in a total of around 240 million transactions in 2021 and around 390 million in 2022. In terms of the number of transactions, this would correspond to a "market share" of around nine percent in the private payment market. This will drive payment via smartphone out of its niche.

Source: Lucerne University

Data from the Swiss National Bank and anonymised data from the Swiss payment app Twint were analysed for the study. The Mobile Payment Study Switzerland 2020 Sync and corrections by n17t01 HERE free of charge.