Own pension provision: Lack of knowledge hinders more personal responsibility

The majority of the Swiss population does not believe it will receive enough money from the AHV and 2nd pillar in old age. New working models are also ensuring that the Swiss pay in fewer contributions. However, many lack the necessary knowledge to look into alternative pension options. This is shown by a study conducted by the Lucerne University of Applied Sciences and Arts, which examines the population's current level of knowledge regarding finances and retirement planning.

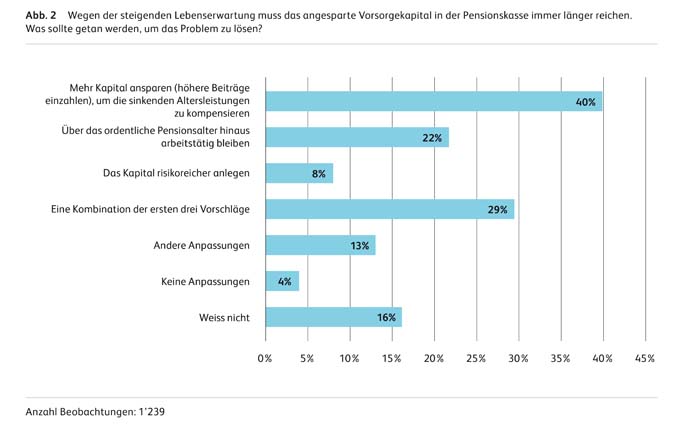

Demographic change and insufficiently high returns to sustainably finance the 2nd pillar: Employees in Switzerland are aware of the challenges in retirement provision. Only just four percent of respondents to the representative HSLU study are opposed to measures to remedy the financing problems of the AHV and 2nd pillar. "Accordingly, respondents' skepticism about pension benefits is high," says Yvonne Seiler Zimmermann, study director and lecturer at the Lucerne University of Applied Sciences and Arts. According to the HSLU study, around three out of five respondents do not believe that they will receive enough money from the AHV and 2nd pillar to maintain their accustomed standard of living in old age. Interestingly, women trust the pension system even less than men. Not surprisingly, younger people have less hope of receiving enough money from the AHV and 2nd pillar than older people.

People want to take personal responsibility for their own retirement provision

One of the megatrends of futurology is individualization in all areas of life. "This trend is leading in particular to people living more self-determined lives and increasingly wanting to organize their work activities flexibly and according to their needs," says Seiler Zimmermann. In addition to flexible working hours and locations, many employees also increasingly want time off during their working lives for further training, sabbaticals, parental leave or to care for relatives. More and more people are also expressing the desire to retire earlier than the statutory retirement age. The study leader is certain: "The megatrend of individualization ensures that people will also have to take on more personal responsibility when it comes to retirement planning." This means, in particular, that people must be able to determine the investment strategy for their own pension capital and make their own provisions for time out. "Otherwise, an interruption in employment can result in a reduction in pensions at a later date," explains Seiler Zimmermann.

Individual pension solutions meet with interest

The survey shows that, at 62 percent, the vast majority of respondents are positive about the idea of determining their own investment strategy. However, 30 percent would like good advice on determining the investment strategy and a further 24 percent would like to be able to choose from a predefined selection of alternatives.

The clear majority of respondents would welcome being able to finance a career break with a special, additional pension account. 82 percent of them would like that. "Most people would therefore be willing to take on more personal responsibility when it comes to retirement planning," says Seiler Zimmermann. "Individual pension solutions are attracting interest.". Most often, respondents would want to use this supplemental account to fund early retirement, followed by sabbaticals. Many respondents would also be content to have such an account without knowing exactly what they will use the money for later.

Ignorance of own knowledge gaps

A minimal level of knowledge regarding finances and retirement planning is required in order to take care of one's own financial provision. The survey results show: The respondents' knowledge of the pension system and their own pension plan is rather modest. "The main problem here is not the lack of knowledge in and of itself, but the unawareness of one's own knowledge gaps," Yvonne Seiler Zimmermann specifies. "If someone is aware that he or she doesn't know something, that person can seek advice or inform themselves," the HSLU expert continues. However, many people lack this awareness of their own ignorance.

This knowledge gap is also particularly evident in the regulations on voluntary retirement provision. "For example, a person who has decided to stop working may no longer pay into pillar 3a," explains Seiler Zimmermann. But many don't know that. Only just 35 percent of respondents know that not all people in Switzerland are eligible to pay into pillar 3a. "Anyone who decides to interrupt their employment should take such factors into consideration," says the HSLU expert. This is just one example of many, she said, of why acquiring knowledge in the area of retirement planning is worthwhile. With this study, the study authors want to draw attention to this issue. Seiler Zimmermann: "Public discussions about pension topics can help to improve the level of knowledge and understanding among the general population."

Source: Lucerne University