MEM sector: negative business climate on the radar

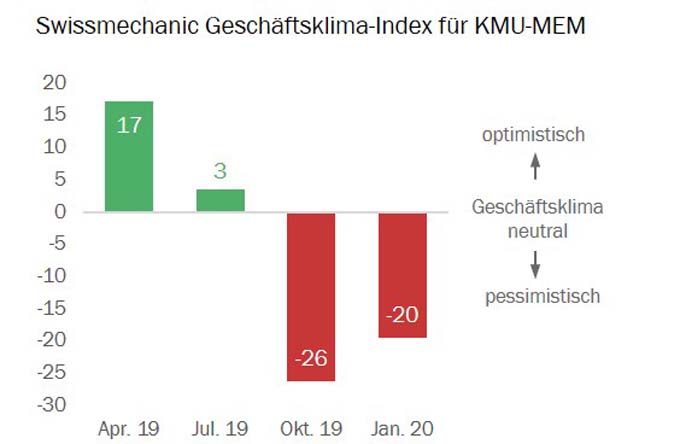

According to the Swissmechanic Business Barometer, the Swiss MEM sector continues to operate in a hectic environment. The Business Climate Index for SME-MEM, calculated for the first time, shows that although the companies surveyed are still pessimistic at the beginning of 2020, they are no longer as pessimistic as they were in October 2019. This, together with the pick-up in Swiss equipment investment and the decline in global uncertainty factors, represents a silver lining for the sector.

The quarterly survey by Swissmechanic, the leading association of Swiss SME-MEM, shows that the business situation of the companies surveyed deteriorated significantly between April and October 2019. While the optimists still outweighed the pessimists in the spring, the pessimists outweighed them in the autumn. At the beginning of 2020, the situation is also assessed as negative by the majority, although to a slightly lesser extent than in October, according to the current economic barometer.

Weak order intake for the MEM sector

"In addition to the strong franc, the weak order intake is currently the biggest challenge," says Jürg Marti, Director of Swissmechanic. As a result, 62 percent of companies are reporting a decline in orders in the fourth quarter of 2019 and only 15 percent an increase. This development is reflected in falling sales and margins. In addition, adjustments to staffing levels are increasingly being considered. For the first quarter of 2020, more companies still expect a deterioration than an improvement in the order situation, but the discrepancy is no longer equally pronounced.

Pressured from two sides

The economic situation in the Swiss MEM sector is being clouded primarily by political uncertainties abroad. The situation is exacerbated by the weakness of the EU's main sales market and the strong franc. Swissmechanic is calling on the Swiss National Bank (SNB) to stick to its chosen course and to continue to ensure consistently and vehemently that the Swiss franc does not become any stronger, but on the contrary weakens. In this way, the SNB is making a significant contribution to strengthening the Swiss economy. This is imperative, because companies in the MEM sector are under pressure from two sides, as it were, due to the strong franc and weak order intake.

Relaxation tendencies

BAK Economics expects the recent easing of the trade conflict between the USA and China and Brexit to continue over the course of the year. The MEM sector can therefore expect foreign demand to pick up by 2021 at the latest. In Switzerland, a recovery in equipment investment can be expected as early as 2020, because the adoption of the tax reform and AHV funding (STAF) has removed a key uncertainty factor. As a result, BAK Economics expects an increasing acceleration in the Swiss MEM sector in 2020/2021.

Source and further information: www.swissmechanic.ch