Insurance: Online interactions on the rise, restraint with AI

The trend toward using online channels for contact with insurance companies continues in Switzerland. Skepticism prevails when it comes to the use of artificial intelligence (AI), according to the third edition of the "Swiss Insurance Monitor" published by the University of Lucerne.

The "Swiss Insurance Monitor 2023" is an annual study conducted by the Institute for Marketing and Analytics (IMA) at the University of Lucerne on customer perspectives in the insurance industry. The survey, which is representative for Switzerland, was conducted in cooperation with VDVS - Verband Digitalversicherung Schweiz, elaboratum suisse GmbH, FinanceScout24 (SMG Swiss Marketplace Group AG) and a consortium of insurance companies, health insurers and service providers.

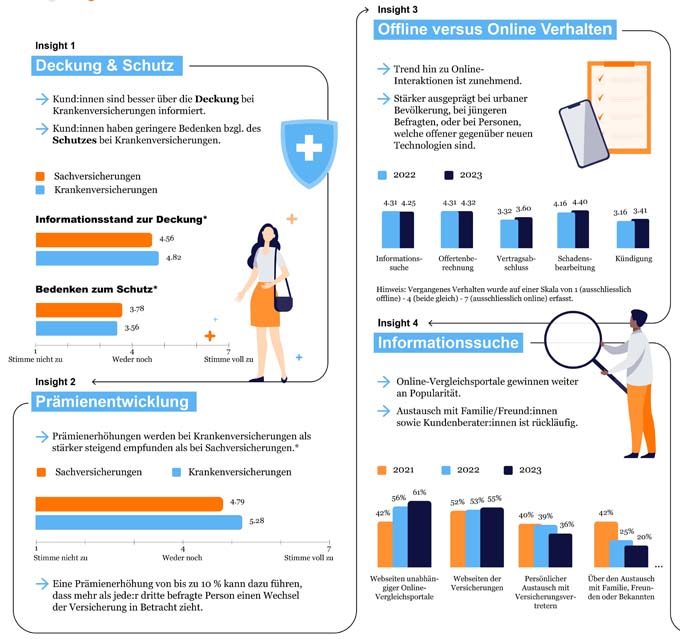

Online versus offline interaction

In Switzerland, people increasingly prefer online platforms such as independent comparison portals and insurance websites when searching for insurance and calculating prices. Nevertheless, they most frequently use personal customer advisors to prepare insurance quotes. The trend toward handling insurance matters online is also evident in claims processing. However, people tend to prefer offline methods when concluding and terminating contracts. People who are technology-savvy and prefer online channels when concluding contracts, as well as urban dwellers and younger age groups, also tend in this direction.

Regardless of the preference for how to interact with insurance companies, customers have a slight preference for direct personal contact (e.g., via phone, email, or in person) when dealing with most insurance concerns compared to options without direct personal contact (e.g., customer portal or insurance app). Thus, customers also highly value their customer advisors at insurance companies and health insurers. 80 % of respondents state that they are satisfied with them and attest to their good accessibility and appropriate frequency of contact.

Potentials and challenges in the insurance industry

As previously noted, respondents are more likely to want to interact with insurance companies online: More than 50 % of customers can imagine signing insurance claims exclusively digitally in the future. In addition to online interaction, 41 % of respondents would like to have the option of simulating claims online, and 61 % of respondents would like to be able to compare new and existing policies online. Customers are undecided as to whether further personal information such as age, education or gender should be included in the premium calculation. However, if this is accompanied by premium reductions, the proportion of customers who are positive about this increases from around 40 % to almost 60 %. Similar behavior is to be expected in the interaction with customer advisors. With regard to interaction with customer advisors, respondents are less willing to pay higher premiums for increased contact - quite the opposite: they would even limit contact if this were accompanied by premium reductions.

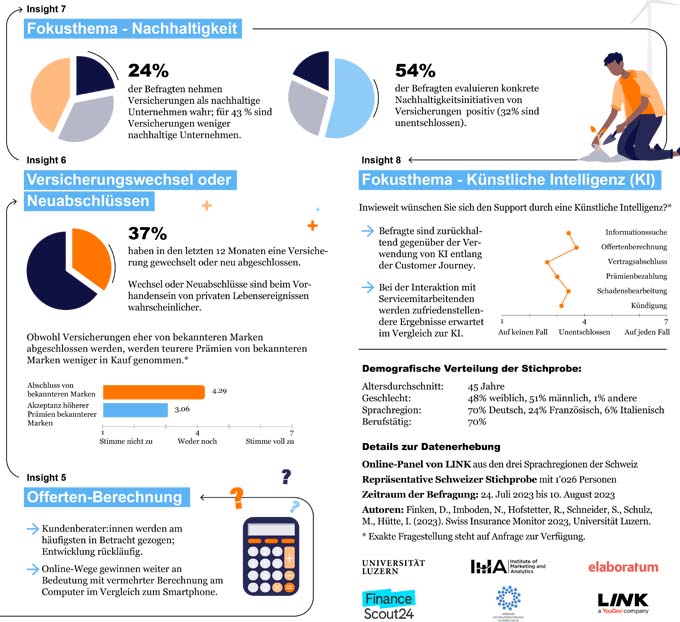

By contrast, only around 25 % of respondents would like to receive video advice by telephone in the case of property insurance and health insurance. In addition, insurance customers are less willing to involve artificial intelligence in clarifying insurance concerns - even when artificial intelligence supports service employees. Trust in service employees prevails insofar as the respondents tend to expect a satisfactory result from them.

Insurance topics: Interest and level of information

The interest of the population living in Switzerland in insurance topics remains unchanged compared with the previous year. However, there are differences in the level of information on insurance topics. In the 12-month observation period of the study, more people sought information on new or alternative insurance offerings and concluded contracts more frequently, compared with the Swiss Insurance Monitor of 2022. The increased engagement and interest could be explained, for example, by a slight rise in insurance premiums for property insurance and health insurance, but also by other external circumstances. More than 80 % of respondents for health insurance and 64 % for property insurance say their insurance premiums have increased at least slightly in the past 12 months. It is not possible to say whether insurance policies are being switched as a result of this.

Sustainability in the insurance environment

In the insurance sector, the issue of sustainability is becoming increasingly important. Insurance customers appreciate it when insurance companies take sustainable measures and generally rate them positively. However, insurance companies themselves are often not primarily associated with sustainability. Nevertheless, insurance companies have the opportunity to make sustainability tangible for their customers. This can be achieved, for example, by increasing the use of digital technologies, promoting sustainable standards in the supply chains of partner companies, and training employees in sustainable behavior.

Source: www.unilu.ch