Innovative capacity

Is Switzerland the innovation leader, as many statistics would have us believe? Switzerland is certainly under pressure. Foreign competitors are catching up and new innovation trends are setting the pace. Swiss industrial companies, and indeed the workplace as a whole, are affected. What needs to be done?

In the Deloitte White Paper on Switzerland as a Business Location of 2013, 50 percent of the companies surveyed cited the technologically improved products of competitors as the reason why global competitive pressure on Switzerland has increased sharply. This assessment is at odds with interna-

Enormous competitive pressure

tional rankings, in which Switzerland regularly achieves a very high level of competitiveness and innovation leadership. For the fifth time in a row, the World Economic Forum (WEF) has listed Switzerland as the most competitive country in the world in its "Global Competitiveness Report". The Innovation Index of the World Intellectual Property Organization (WIPO) has been led by Switzerland for three years. Are Switzerland and its industrial companies really that innovative and competitive, and is there still room for improvement? Switzerland's ranking should be viewed with caution, especially since Switzerland traditionally has many headquarters that centralize intellectual property (IP). This means that not all IP registered in Switzerland is also invented in Switzerland.

Potential for improving Switzerland as a location for innovation

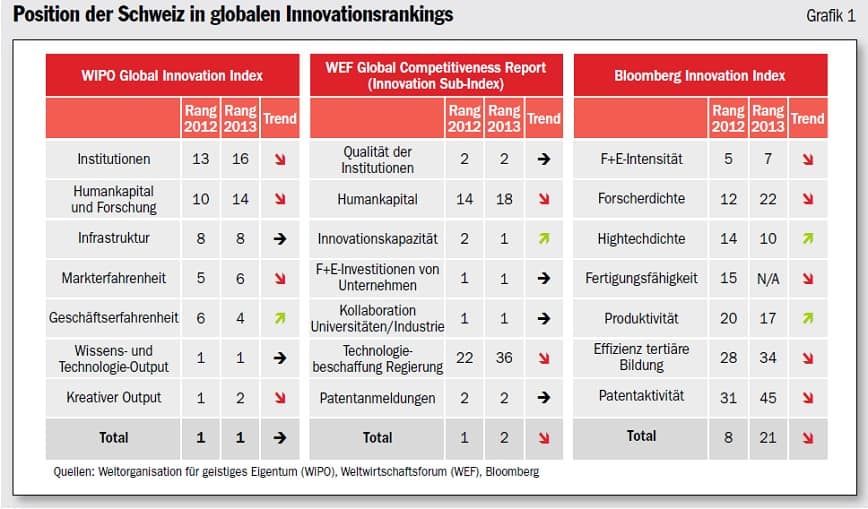

A closer look at the best-known innovation rankings reveals weaknesses and potential for improvement. According to WIPO, WEF and Bloomberg, Switzerland is losing ground to its competitors in terms of human capital and researcher density (see chart 1). Interviews with experts from companies, industry, public authorities and universities conducted as part of the current Deloitte study "Innovation - reinvented" confirm this finding. The practical training of scientists is considered to be in need of improvement. The attractiveness of Switzerland for international researchers must be increased, the experts say. Cooperation between universities and industry must be further professionalized. The experts consider the slow implementation of innovations to be the most important weak point, which is linked to the Swiss mentality of risk aversion and a tendency towards perfectionism.

In order for Switzerland to maintain its leading position in the longer term, it needs more courage to take risks and entrepreneurship to increase the speed of innovation. Technology transfer programmes must be expanded and more vertical networks established. There is also a need for more "open innovation" and an even stronger positioning of Switzerland as a top education location.

Trends and challenges

We see the workplace and its industrial companies challenged by three strong trends:

1. accelerated innovation processes of competition are putting Swiss industrial companies under pressure. The speed of innovation is not one of Switzerland's strengths. Innovation processes or product lead times often take longer than abroad. Swiss industrial firms are good when it comes to brainstorming, i.e. the creative part of innovation processes. They show weaknesses in innovation itself, i.e. in product development. According to experts, there is also room for improvement in the market launch process. Global competitors are quicker to market with their innovations. Examples from the machine industry show development times in Asia that are sometimes half as long. The "slowness" of Swiss industrial companies in innovating results in high quality - with the risk that Swiss products may be outdated by the time they reach the market.

2. the increasing internationalisation of R&D, originally triggered by production relocations driven by Swiss industrial companies in recent years, is now increasingly shaped by the need to develop products for new growth markets, and to do so locally. However, there is hardly any strict geographical separation of production from R&D any more. In times when value chains are set up internationally, R&D is also integrated into a global system. If production is relocated to new growth markets or newly established, the same often happens with product development. Research follows immediately. There are several reasons for moving R&D to new production facilities abroad. Cost advantages were only one start (such as cheaper

New understanding of innovation

product development in India than in Switzerland), more important are often advantages resulting from R&D activities close to production. Local manufacturing adjustments close to the market, early detection and correction of errors, necessary know-how exchange with local developers when developing product variants in new growth markets and products specifically developed for "low-cost markets" are important drivers.

3. a decisive factor for long-term competitiveness is a new understanding of innovation that goes beyond the usual product innovations. Traditionally, innovation has been related to the product offering. Innovation must also take place in internal company structures, processes and revenue models. Further future potential lies in customer-facing functions, such as new services and sales channels, a strong brand or unmistakable customer integration. Today, Swiss industrial companies are mostly focused on incremental improvements. However, real added value for customers requires a comprehensive understanding of customer needs and process depth. This means that the focus must not only be on the functionality of new products; product quality often cannot be pushed any further. Only in part do Swiss industrial companies pursue innovative solutions in the service area, improved integration of customers, new development cooperations or process innovations.

Considerable R&D expenditure by Swiss industrial companies

Swiss industrial companies are required to invest their R&D expenditure well. Fortunately, the focus on innovation is already very important. In the Deloitte White Paper on Switzerland as a place to work, 79 percent of the companies surveyed confirmed the central importance of innovation in their corporate strategy.

On average, leading innovation companies in Swiss industry invested a good five percent of their turnover in R&D per year. There are differences between sectors, with the mechanical engineering industry and the electronics/electrical engineering sector spending just over three percent on R&D and the chemicals and precision instruments sectors investing an average of 4.2 and 6.4 percent respectively. These Swiss values can largely be compared with international benchmarks on R&D intensities.

A higher budget for R&D does not guarantee a higher innovation output. Large companies with huge research budgets are relatively often less capable of innovation than small companies with few financial resources. What measures can strengthen the innovation and thus competitiveness of companies?

Improving the capacity for innovation

A first important approach is to focus on innovation management. Innovation processes accelerate and innovation cycles only become shorter if strategy, organization, project portfolio management and product development are synchronized. The best protection against the competition is to bring innovations to market faster. This has strategic importance. Management must not only orchestrate across business units, but also be responsible for the comprehensive strategy that addresses all aspects of innovation in order to remain competitive and differentiable as a company. Current and future market needs of customers must be understood and aligned with the company's own capabilities so that its own know-how can be used to differentiate itself from the competition.

The organization of innovation activities involves the clear definition of tasks and responsibilities. The increasing internationalization of R+D makes it necessary to allocate the

The whole company is challenged

The new structure will make it necessary to improve workflows and decision-making structures between headquarters and the regions. Technology development, which is often still carried out by Swiss industrial companies in Switzerland itself, must be coordinated with product development, which is increasingly taking place close to production in new growth markets. Prioritization plans for budgets and personnel must be defined according to clear criteria, whereby "product lifecycle management" and "make or buy" considerations must be included.

For the future success of a company, it is crucial to look beyond one's own product innovation when innovating. Innovation must not be a one-dimensional matter, but must encompass different dimensions of a company (see Figure 2).

In addition to new product offerings, innovation must address revenue models, structures and processes (configuration) with the inclusion of the network. Important types of innovation are in the area of customer application (experience). The most successful companies include a comprehensive consideration of new services, the expansion and improvement of distribution channels as well as the exploitation of the brand. Customer interaction innovation is important. This is where the focus of industrial companies has often been in its infancy, as the product has been the focus. In doing so, the dependence on products and technologies can be reduced and "copyability " can be reduced.

Our empirical surveys show that the stock performance of companies that consistently follow this approach outperforms that of their peers and does much better than the S&P 500 index.