How COVID-19 is changing the role of risk managers

Where will Risk Managers stand after December 2019? By spring 2020 at the latest, the roads in Switzerland will also be empty. Until then, an almost unimaginable scenario. What did this emergency mean?

The focus of the "ERM Study 2020" is the question of how the demands on risk managers have changed in times of the Corona crisis. Can risk managers meet the requirements? Has management adjusted the management rhythm? And what impact will the crisis have on the future of the risk management profession? These questions are answered by the study, which the Institute of Financial Services Zug IFZ of the Lucerne University of Applied Sciences and Arts wrote together with the Institute of Controlling of the Kiel University of Applied Sciences and Arts and the SwissERM association.

Adjustment of the business model imperative

The Covid 19 crisis once again highlighted the force with which even risks that are considered to be rare can occur. This fact comes as no surprise to risk managers - and yet they were amazed at the speed with which the pandemic affected life and the economy in Switzerland. "This should have been a wake-up call for companies to address potential weaknesses in their own business model," says Stefan Hunziker, study author and lecturer in risk management at the Lucerne University of Applied Sciences and Arts. "This requires a holistic and company-wide systems approach to risk management in order to regularly review and improve the company's resilience," says Hunziker. In particular, the assessment of consequential risks at the macro level requires the evaluation of different sources of information and the transfer of the findings to one's own company. According to the study author, it is imperative that the risk manager and the top management of a company actively follow world events in order to be able to assess and manage possible external causes with internal effects. This also includes close and transparent cooperation between risk management and top management. It is true that a crisis often triggers more intensive communication between the risk manager and those responsible for the company, which can certainly be seen as positive. "However, it would be desirable if this were permanent and not just in the event of a crisis," says Hunziker.

Is the risk manager also the crisis manager?

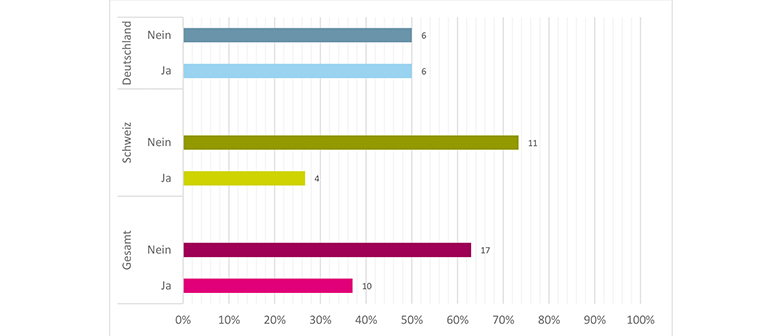

The risk managers surveyed were - and still are - heavily involved in the current crisis. Interestingly, however, the majority of the risk managers surveyed were not also working as crisis managers (see Figure 1). In the majority of cases, the dual function is even seen as critical, as different decision-making competencies are required in the two functions. Moreover, in the opinion of some risk managers, implementation and decision-making cannot function simultaneously. Nevertheless, intensive cooperation between the two functions is necessary. The operational separation of the two functions depends, among other things, on the size of the company, its organisational integration and the resources available.

If these two roles are combined in one person, the risk manager must assume the crisis management function in addition to the standard risk management tasks. As a result, the focus of the risk manager during the crisis is more strongly directed towards business continuity management and the coordination of the implementation of appropriate crisis management measures. In some cases, the Risk Manager is also responsible for the legal assessment of the Corona regulations and the preparation of hygiene concepts, occupational health and safety measures and pandemic plans. It is therefore not surprising that this part of the interviewees perceived a clear change in their current tasks towards the crisis manager.