Green wave or just a niche?

The assets of sustainable mutual funds in Switzerland increased by 22 percent over the past year to CHF 196 billion. Conventional mutual funds have declined slightly over the same observation period. Nevertheless, the business with sustainable investments remains a niche market, as the "IFZ Sustainable Investments Study 2019" by the Lucerne University of Applied Sciences and Arts shows.

The range of sustainable investments is becoming more diverse: The number of sustainable mutual funds has risen from 434 to 582 funds (+34 percent) compared to the previous year. The assets under management in these funds rose from CHF 161 billion to CHF 196 billion (+22%). Measured against the volume of conventional funds, the market for sustainable investments remains a niche.

Globally active universal providers are competing fiercely with established sustainability specialists in a market that just a few years ago was considered an exotic segment for environmental idealists. Global asset managers are offering investors an increasingly broad range of products. The leading providers each launched ten or more new sustainable mutual funds last year.

Enormous momentum for passive funds

Of the 582 sustainable funds, 82 are passively managed. In terms of assets, this corresponds to a share of 11 percent. In the conventional investment segment, this share is twice as high. However, the passive sustainability fund segment is showing enormous momentum. Existing sustainable passive funds have attracted around five billion francs in new money, which corresponds to a net inflow of funds of a whopping 38 percent. Last year, 38 new sustainable passive funds were launched. The fees of passive sustainability funds are falling hand in hand with this development.

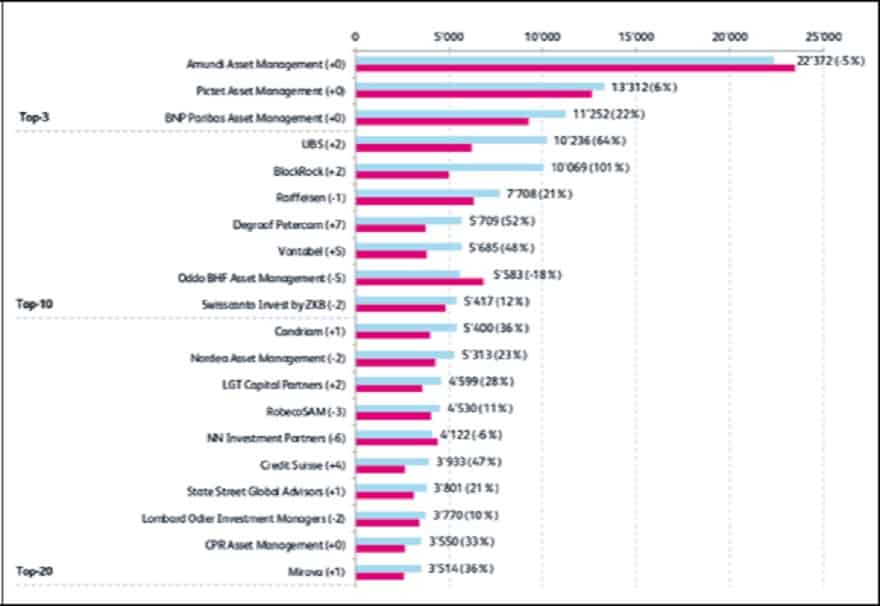

The total of 582 sustainable funds are offered by 145 fund providers - see figure below.

Green bond funds

The Sustainable Investments Study 2019 highlights that 135 of all sustainable mutual funds - i.e. around a quarter - invest in sustainable bonds. This asset class primarily includes bond funds in which the fund manager subjects the bond issuer to ESG screening. It also includes funds that invest in green bonds. The proceeds from the issue of green bonds are used for environmental and climate protection projects.

"The growth figures for green bond funds demonstrate the need of investors to invest transparently in environmentally friendly projects. One advantage is the good traceability of the use of funds and the measurement of impact. Regulatory initiatives such as the EU Action Plan promote the standardisation of green bonds and give the topic a boost," says Manfred Stüttgen, co-author of the study and lecturer at the Lucerne University of Applied Sciences and Arts.