Losses: Fire, explosions and aircraft collisions cause the greatest losses for Swiss companies

According to a global analysis of more than 470,000 claims by the insurance group Allianz, 87 percent of all claims are due to technical or human error. Natural catastrophes play only a minor role.

Cyber risks and the impact of new technologies will increasingly influence the claims situation for companies in the coming years. However, traditional causes still dominate: The largest losses for insurers and their corporate clients worldwide continue to be caused by fire and explosions. This is the result of a recent analysis by Allianz Global Corporate & Specialty (AGCS). Although hurricanes and other natural catastrophes have also caused devastating losses in the last two years, by far the largest number of insurance claims are reported by companies due to technical and human failures. In Switzerland, too, the largest losses continue to be caused by fire and explosions.

Few causes - much damage

In its current study "Global Claims Review", AGCS discloses the most important causes of claims in industrial insurance. The data basis was 470,000 cases from the last five years (July 2013 to July 2018) from more than 200 countries and with a total value of approximately EUR 58 billion. According to the report, the largest financial losses - more than 50 per cent of the total value of cases analysed - are attributable to fire/explosions, aviation loss events, faulty workmanship/lack of maintenance and windstorms worldwide. More than 75 percent of losses worldwide can be attributed to ten major causes of loss.

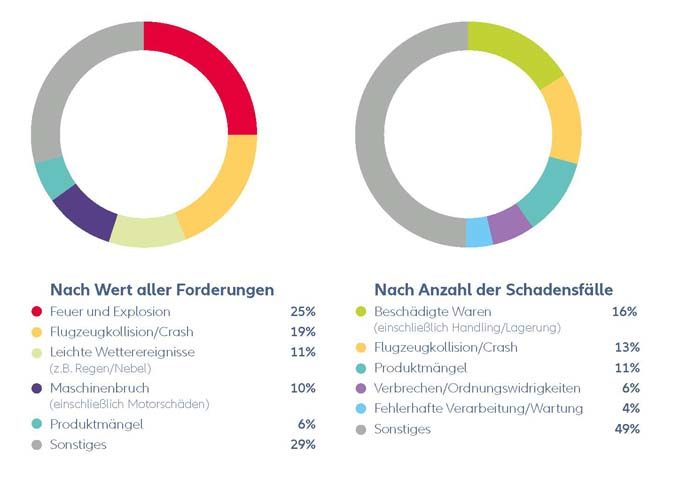

The biggest loss drivers in Switzerland

In Switzerland, too, the largest losses continue to be caused by fire and explosions. They accounted for 25% of the total value of all losses in the period under review. They are followed by aircraft collisions (19%) and light weather events such as fog or rain (11%). In terms of numbers, claims due to damaged goods occur most frequently (16%).

"The analysis shows that ever higher values are at stake for companies and their insurers," says Christoph Müller, CEO of AGCS Switzerland. "In the interconnected and globalized economic environment we find ourselves in today, asset losses are on the rise." On the one hand, he says, this is due to the geographical concentration of values - not infrequently in regions with high risk exposure - but also to domino effects along supply chains and in networks that span the entire world. Philipp Cremer, Global Head of Claims at AGCS: "Looking ahead, new technologies will bring business benefits but also new risks and insurance losses. However, they also give us the opportunity to prevent or at least reduce losses and optimise claims settlement for our clients."

Events become more expensive

The values destroyed by fire and explosions in the last five years amount to more than EUR 14 billion (around CHF 15.8 billion). Excluding natural catastrophes, more than half (11) of the 20 largest insurance events analysed were due to these causes. On average, almost EUR 1.5 million (around CHF 1.7 million) was involved per fire claim. "In general, in property insurance, both inflation and higher value concentration are driving up loss amounts - this has to do with globalization and the increasing level of integration in supply chains," explains Raymond Hogendoorn, Property and Engineering Claims Specialist at AGCS. "Efficiency in industry is increasing and as a result the value per square metre has increased exponentially. Accordingly, fire and flood damage per square metre is also significantly more expensive today than it was ten years ago.

Business interruptions as cause for cost explosion

The costs of business interruption (BI) contribute significantly to the total amount of damage caused by fire/explosion or other triggers. BUs now play a significant role in almost all significant property insurance claims: on average, BU losses under a property insurance policy amount to more than EUR 3 million. This is around 39 percent more than the average direct property loss (EUR 2.2 million).

Although natural catastrophes have recently destroyed unprecedented assets in the US and many other countries around the world, they are not the largest loss driver. Analysis has shown that industrial insurance losses are typically due to technical or human error - or other factors unrelated to natural catastrophes. Their share of the total value of all claims is 87%.

Fires and repairs in aviation are becoming more expensive

While the global aviation industry recently celebrated its safest year on record, there is no indication that the industry is reporting fewer claims as a result. Aircraft crashes and collisions in aviation are the second most important cause of damage. Composite materials are driving up repair costs and the use of more technically complex engines is also having an impact.

Analysis has also shown that insurers have settled claims averaging EUR 32 million per day over the past five years - AGCS alone paid its policyholders EUR 4.8 billion in 2017 as a whole. The industry is increasingly turning to innovative technologies to streamline claims handling processes. Smaller and more frequent claims can be settled faster thanks to machine learning and robotics. AGCS also uses satellite imagery and drones to more quickly assess and measure damage caused by storms or floods after natural disasters. This makes it possible to better manage the deployment of scarce resources (e.g. damage assessors or craftsmen) and speed up the payment of insurance benefits.

Source: Allianz Suisse