Loss statistics: weather extremes on the rise

AXA figures show an increase in storm damage over the last three years. It would be premature to speak of a trend, but thunderstorms now occur at shorter notice than in the past and their intensity has increased. At the same time, preventive measures taken by the federal government, cantons and municipalities are having a positive effect on the extent of damage.

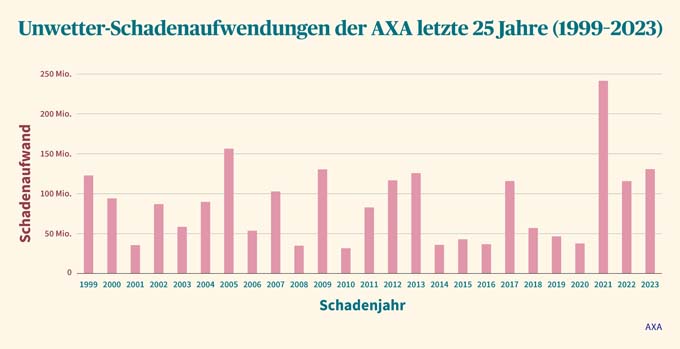

As the largest all-lines insurer in Switzerland, AXA has comprehensive data on where, when and to what extent damage has been caused by storms in recent years. The statistics for the last 25 years show that 2021 was an absolutely exceptional year in terms of both the number of claims and costs. However, 1999, 2000, 2004, 2009, 2012, 2013, 2022 and 2023 also saw very high levels of damage, while 2014 to 2020 were rather quiet years (Figure 1). The picture is similar for claims costs (Figure 2), with AXA's average claims being exceptionally high in 2005 and 2017. This is due to the Alpine floods in 2005, which caused widespread flooding, and to several major claims in 2017 as a result of heavy regional rainfall.

More intense storms, more prevention

"We have noticed an increase over the last three years. However, this is too short a period to speak of a trend. Storm damage is very volatile," says Stefan Müller, Head of Property Damage Insurance at AXA. "However, our experience shows that storms now occur at shorter notice than in the past and their intensity has increased significantly: extremely strong gusts of wind, more heavy rain, more frequent large hailstones - and all of this is sometimes localized and small-scale." This has created new dangers. For example, heavy rain in densely populated areas can turn streets into dangerous rivers and literally flood underground car parks. This is only partially reflected in the statistics, as the federal government, cantons and municipalities have also invested more in protective measures. Flood relief tunnels, retention basins, raised dams and the national flood hazard map are paying off.

Hail damage as a key driver

Not all regions in the country are exposed to the same risk. AXA's claims statistics show a clear picture of where which type of damage occurred most frequently. Hail damage to cars accounts for the largest proportion of storm damage, both in terms of the number of cases and the costs incurred. In the last twenty years, the cantons of Jura, Ticino and Neuchâtel, but also Nidwalden, Obwalden, Lucerne, Schwyz and Bern have been particularly affected. "Major hailstorms in particular, which damage a large number of cars in a short space of time, can be a major driver of the claims balance," says Patrick Villiger, Head of Motor Vehicle Claims at AXA. In contrast, there was hardly any hail damage in the cantons of Schaffhausen, Geneva, Graubünden, Glarus and Thurgau.

Frequent flooding in the canton of Schwyz

Over the last ten years, the canton of Schwyz has suffered the most flood damage per insured household, followed by the cantons of Solothurn, Thurgau and Lucerne. It should be noted, however, that individual events were very significant in each case. The cantons of Vaud, Graubünden, Basel-Land and Uri have been spared flooding for the most part in the last ten years.

Ticino has the most lightning

One canton clearly leads the statistics for damage caused by lightning: In the last ten years, the risk of damage caused by lightning was seven times greater in Ticino than in the rest of Switzerland. AXA counts several hundred household contents claims in this canton every year. Compared to Basel-Land, Vaud and Geneva, the risk was even 25 times higher. The reason is understandable: When warm, humid Mediterranean air is pressed against the Alpine chain, thunderclouds form with strong updrafts and downdrafts and high electrical voltage. This discharges in lightning.

Insurance for storms

Depending on the damaged property, different insurance policies come into play. Storm damage to furniture and furnishings is covered at replacement value by household contents insurance. Damage to vehicles is covered by partially comprehensive insurance. And building damage is covered by buildings insurance, which in most regions is provided by the canton.

Source: www.axa.ch