Climate risks as a long-term challenge for companies

Climate change is a highly complex and constantly changing risk for companies. For risk managers, it is becoming increasingly difficult to assess climate-related risks and to provide decision-relevant information for management. Nevertheless, climate risks still have a low priority at many companies, as the ERM Report 2022 of the Lucerne University of Applied Sciences and Arts shows.

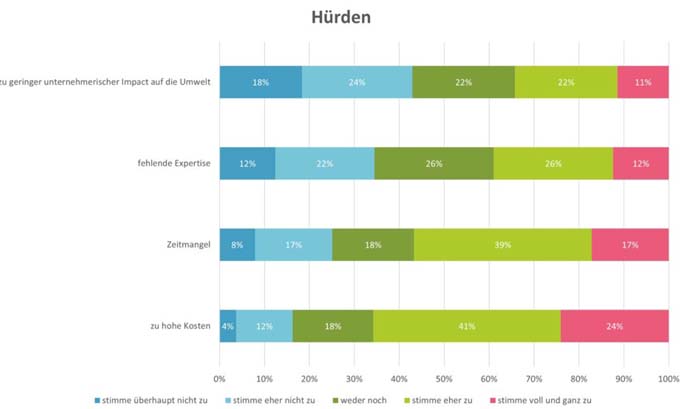

The business activities of companies impact the environment through various channels - whether in the form of greenhouse gas emissions, energy consumption, waste management and water consumption, or in the form of environmental aspects in the products and services offered. Accordingly, companies have a responsibility to do everything they can to reduce the impact they have on the environment. "Not all organizations in Switzerland and Germany meet this responsibility equally well," says Stefan Hunziker, author of the ERM Report 2022 and head of the Risk & Compliance Competence Center at the Lucerne University of Applied Sciences and Arts. The results of the ERM Report 2022 show: The biggest hurdle to greater environmental responsibility is the cost required to become more environmentally friendly as a company. Around two-thirds of respondents perceive this as a major hurdle. SMEs in particular also see a perceived lower impact on the environment on their part, which results in lower environmental responsibility (see figure below).

Added to this is the perceived pressure on companies from internal and external stakeholders, which has an impact on corporate environmental responsibility. This means that the stronger the perception of pressure on a company, the more pronounced their environmental responsibility. Large companies in particular perceive this pressure significantly more strongly than SMEs. In all the dimensions of environmental responsibility surveyed, large companies are therefore somewhat ahead of SMEs and already have their environmental responsibility explicitly audited and evaluated by external bodies. This promotes the improvement of the companies' image with regard to their environmental responsibility, which is considered to be the strongest advantage perceived as a result of their own company's environmental responsibility.

Climate risks are only of medium importance for companies

Climate change entails numerous adverse effects for humans and the environment due to the complex interactions and interdependencies between a wide variety of elements of the ecosphere. All economic and social actors must adapt to this new reality. In order to better classify the topic, the subjects of the HSLU study were first asked to assess how they were affected by various risks in their company. It becomes clear that climate risks are primarily only assigned a medium significance. "Market risks and strategic risks are considered to be more important, which is surprising given the topicality of the issue," says Hunziker.

Difficult categorization within risk management

In particular, companies struggle to categorize climate risks, as the HSLU study shows. One in three companies does not categorize climate risks as a separate risk category in the corporate risk management process. "In addition, only one in two companies also assesses climate risks in an interdisciplinary manner across different functions and areas in the company," says the HSLU expert. The study author adds: "Taking into account all the indicators recorded, it can be stated that regular and equal recording of climate risks as an independent risk category would significantly increase the significance of climate risks in corporate risk management.

Companies rely on self-assessment

One in three companies does not assess climate risks at all. According to the study authors at HSLU, this is due in particular to the lack of available historical data on climate risks. "Companies assessing climate risks also rely more on their own self-assessment as a method for risk assessment," says Stefan Hunziker. Here, the lack of skills to analyze and assess climate risks seems to be the biggest challenge.

Unsatisfactory integration of climate risks

Finally, the company representatives were asked to assess their satisfaction with the current level of maturity of the integration of climate risks into risk management. A large proportion of them (around two-thirds) are dissatisfied or at most partially satisfied with the consideration of climate risks as part of enterprise risk management. Only one in thirteen companies is very satisfied with the handling and integration of climate risks into risk management. "This set of topics is still very new for many companies," Hunziker said. Many companies are just starting to deal with a possible integration into risk management. There still seems to be a great deal of uncertainty regarding the recording, analysis and evaluation of such risks. However, many of the respondents simply do not yet see the relevance of this topic for their company. Stefan Hunziker: "There should be a change in thinking here so that companies are prepared to invest more time and financial resources in building up the necessary know-how.

Source: Lucerne University

ERM Report 2022

Companies are exposed to a multitude of regulations, internal voluntary commitments and the expectations of various stakeholders. As a result, they have to think about how they want to deal with the climate risks of their business activities. The ERM Report 2022 therefore focuses on the question of how far advanced the integration of these risks into the enterprise risk management of companies in Switzerland and Germany has already been. From the results of the survey of German and Swiss companies, the study authors derived key messages for practice, which also point to further potential for improvement in dealing with climate risks. The study was written by the Institute of Financial Services IFZ at the Lucerne University of Applied Sciences and Arts together with the Institute of Controlling at Kiel University of Applied Sciences.