CH companies on the upswing - new risks on the horizon

According to Deloitte's CFO survey, the Swiss economy is continuing to pick up speed, but the risk assessment is changing significantly. Currently, 60 percent of corporate sales are back at or above pre-crisis levels. The respondents assess the economic outlook for the next twelve months as positive. At the same time, supply bottlenecks, a shortage of skilled workers, price pressure and the threat of inflation are weighing on the outlook.

The vast majority (83 %) of chief financial officers (CFOs) surveyed in Switzerland agree that the Swiss economy will continue to grow over the next twelve months. This is the third highest figure since the Deloitte CFO survey was first conducted in 2009. Only four percent of the CFOs surveyed expect a downturn.

"The Swiss economy has suffered temporarily. However, thanks to targeted government intervention and an overall robust and broad-based structure, it will emerge from the pandemic stronger and faster than many other OECD countries," says Reto Savoia, CEO of Deloitte Switzerland. "This is very positive news, provided that neither policymakers nor companies rest on their laurels now, but respond consistently to the new risk situation."

Company outlook predominantly very positive

The 114 CFOs surveyed expect their key performance indicators to increase over the next twelve months; this applies to the number of employees, sales and investments. A high 79 percent of the CFOs surveyed anticipate revenue growth over the next 12 months, and only 7 percent expect a decline. More than half of CFOs (53%) expect to hire more people than they leave in the next 12 months. According to CFOs, spending on marketing, events and business travel is likely to rise particularly sharply. The only area in which the proportion of CFOs with a positive outlook has decreased is margin development.

Further, as of the September 2021 survey date, 60 percent of CFOs said their revenues were back to or above pre-crisis levels, nearly twice as many as in March (34%). A year ago, that figure was 18 percent. "Many companies have actually overcome the crisis and have enough orders again. However, they are often unable to fulfil them in full due to a lack of materials and staff. As a result, the pressure on margins is increasing," explains Alessandro Miolo, Managing Partner for Audit & Assurance at Deloitte Switzerland.

Delivery problems and shortage of skilled workers

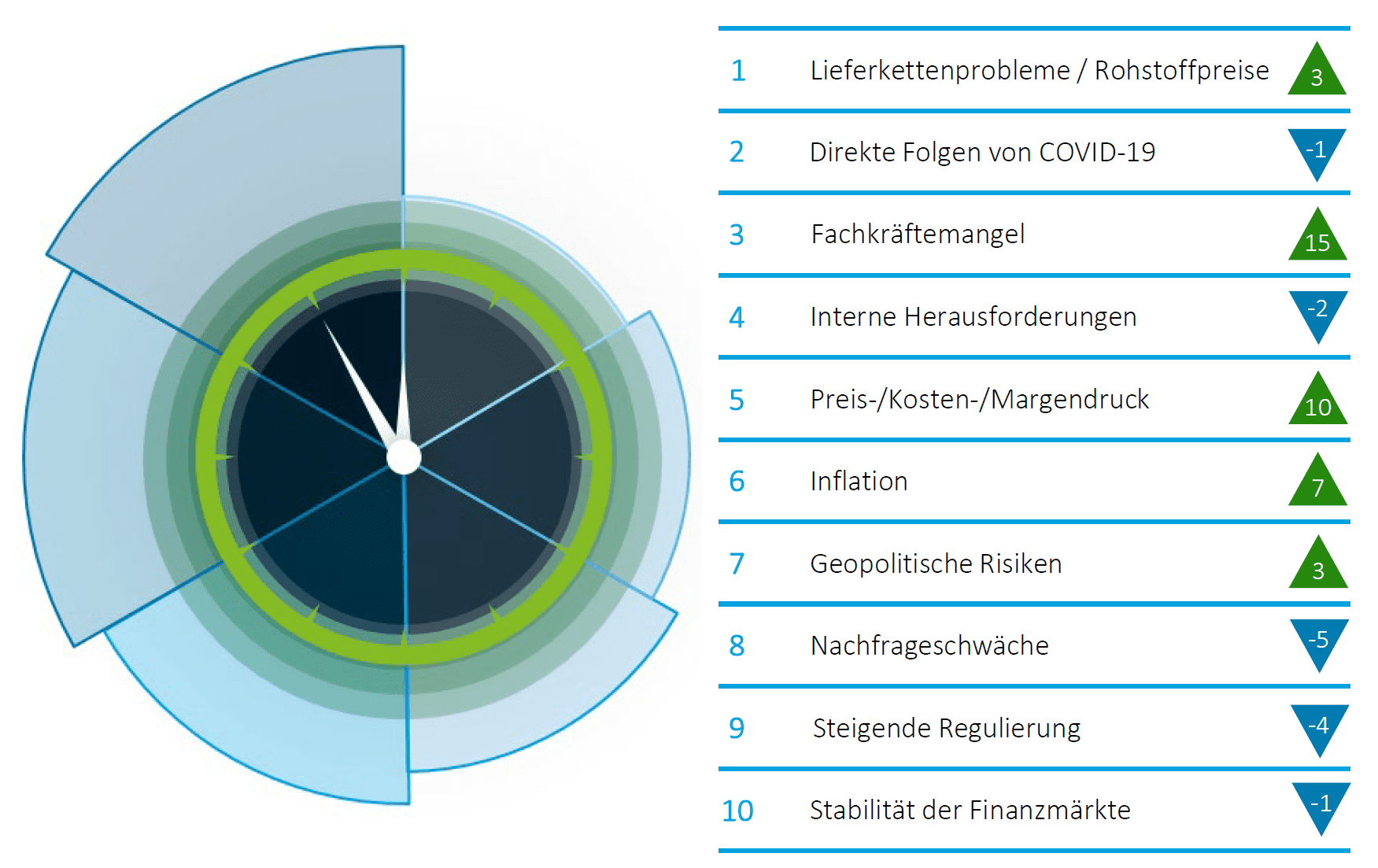

"The risks for companies have changed more significantly than ever before in the space of six months," says Alessandro Miolo (see chart). For the first time, CFOs cite all their activities related to the flow of materials and information from purchasing to delivery as the biggest business risk, the audit and advisory firm writes.

The complex and highly globalized supply chains were not prepared for a global pandemic, nor for the current strong growth in demand. "Crises with similar effects on global trade as the Corona pandemic can, however, happen again. With a foreign trade ratio twice the OECD average, stable and sustainable supply chains are particularly important for Switzerland. Policymakers should therefore continue to simplify and digitalise the customs system and secure free trade with agreements - and companies need to manage their suppliers and distribution more actively and drive forward the digitalisation of supply chain networks," Miolo continues.

Productivity must increase more

In addition to general supply chain concerns, rising raw material prices and a lack of transport capacity, the shortage of qualified employees is once again a major issue, he said. "The issues around supply chains and skilled labor, combined with pressure on margins and rising inflation, make for a dangerous cocktail of risks that is not easy to digest," says Miolo.

The shortage of skilled workers has jumped up a whole 15 places in the CFOs' risk assessment, writes Deloitte. For companies with ambitious growth plans, it is therefore crucial that key employees stay with the company. "In addition, companies also need to make it easier to recruit top international talent, as the approval processes are complicated and burdensome, and successful foreign university graduates are leaving the country in large numbers. Companies must also continue to invest in new technologies - as many did successfully during the pandemic. This should also help to finally reignite productivity growth and enable sustainable growth," says Deloitte CEO Reto Savoia.

Download the Deloitte study here