Automotive upheaval

The automotive industry is in its third revolution. The first revolution was initiated by Henry Ford, who developed the passenger car into a mass product. The second revolution was experienced by the automotive industry in the 1970s and 1980s. This consisted of extensive product differentiation. And now the third revolution: Driven by societal megatrends, the automotive industry must realign itself.

Mobility is and will remain a megatrend of the future. But how this mobility is used will change dramatically. And the automotive industry must face up to these changes if it does not want to become a victim of disruption in the long term.

From manufacturer to mobility service provider

There are three trends in particular that are driving technological development in the automotive industry: Connectivity, mobility and ecology. Connected vehicles, autonomous driving, car sharing models and, last but not least, the electrification of cars are the consequences of this. Customers still want individual mobility, but they want it to be sustainable and as ecological as possible. The industry is therefore faced with the challenge of responding to these developments with new business models. However, this also means that companies have to fundamentally rethink their established ways of thinking in some cases. "Against the backdrop of increasing competitive dynamics, existing leadership and management processes must be adapted to the requirements of knowledge workers and the knowledge culture," writes Felix Pfeil from the University of Würzburg in his 2018 publication "Megatrends and the Third Revolution in the Automotive Industry".

Trends in the automotive industry: Five areas

It is becoming apparent that automotive groups are increasingly transforming themselves from pure manufacturers into integrated mobility service providers. This is also the view of the analysts at PwC. They have taken a close look at the automotive industry and identified five areas that can be considered drivers of the automotive sector.

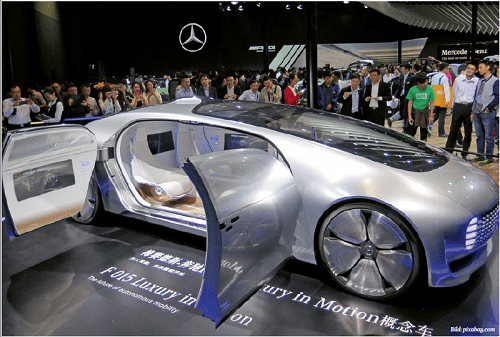

- The vehicle: The car of the future will be "eascy". That means: electrified, autonomous, shared, connected, updated yearly. In other words, the future car will be better for air pollution control because it will be electrically powered - provided that the electricity also comes from non-fossil energy. It is not the cars themselves that will be bought in the future, but their use that will be paid for (mobility-as-a-service). Overall, a vehicle should become more affordable for users in the future.

- The users: The technology-savvy generation will continue to drive the development of mobility. However, different "user types" will continue to exist in parallel in the future. While a young, tech-savvy and urban segment of the population will rely on shared services, autonomous taxis or buses, and (electrically powered) public transport, other segments of the population - such as families or older people in more rural areas - will continue to focus on their own cars. However, their use will become more differentiated.

- Mobility: According to the PwC analysis, 40 percent of the kilometres driven in Europe in 2030 will be covered by self-driving vehicles. Passenger kilometres will increase by 23 percent. The trend towards "using instead of owning" (see point 1) will be reinforced by the increase in digital mobility services, e.g. online ride-sharing services, car-sharing platforms or taxi companies offering their services via app.

- The automotive market: The increase in shared mobility services will mean that the number of registered vehicles will tend to fall, but the utilization rate will rise. PwC analysts predict that in 2030, the vehicle population in Europe will reduce from 280 million to 200 million cars. 55 percent of newly registered vehicles will be electrified in Europe in 2030.

- Automotive value creation: Automobile manufacturers and their suppliers are forced to position themselves with customer-oriented innovations. There will have to be a change in strategy from "technology driven" to "service driven" to "innovation driven". Remarkable: Among the 10 most innovative companies (as of 2017) there is only one automotive company, Tesla Motors ...

Alternative drives on the rise

From a technological point of view, the gasoline-powered internal combustion engine is likely to become a discontinued model. Measured in terms of current car sales, it doesn't look that way yet. But according to auto-schweiz, the umbrella organization of the Swiss automotive trade, 21,591 vehicles with alternative drives were put on the road in 2018. This is an increase of 23 percent compared to 2017. Electric, hybrid, CNG and hydrogen vehicles accounted for 7.2 percent of the total market. Electric cars and plug-in hybrids accounted for nearly half of alternative enrollments, with their market share at 3.2 percent. It is likely to be in the interest of car manufacturers and dealers to ensure a broader range of offerings. The generation of consumers for whom owning their own car is a decisive factor in their quality of life still dominates. But this paradigm is coming under pressure - and with it an industrial sector that is literally the "engine" of entire economies.