Pension fund index struggles to maintain level in quarter

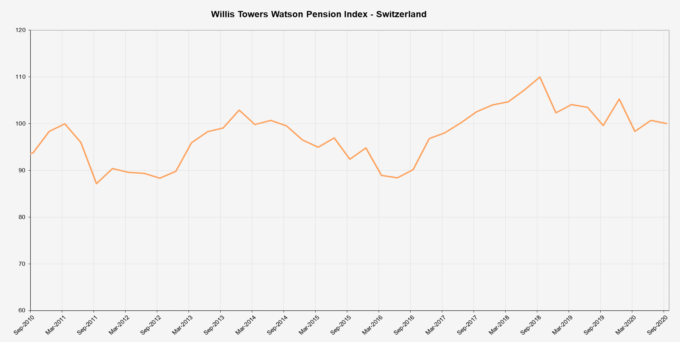

The Swiss Corporate Pension Index shows divergence in another volatile quarter, with corporate balance sheets struggling to maintain levels. Although bond yields declined for the third consecutive quarter, the Willis Towers Watson Pension Index held just above 100%.

The Pension Fund Index is published quarterly by Willis Towers Watson in their Swiss Pension Finance Watch and is based on International Accounting Standard 19 (IAS 19). The index represents the quarterly development of the funding ratio under IAS 19 instead of reporting the otherwise typical funding ratio of Swiss pension plans.

Recovery in assets does not offset increased pension obligations

With the start of the fourth quarter, companies are increasingly focusing on their financial statements, which includes the valuation of their pension plans. With discount rates negative for the shortest maturities and around 0.1% for the remaining maturities, companies are again facing the risk of increased liabilities at year-end. In addition, the recovery that began after the first wave of the coronavirus pandemic slowed in investment markets in Q2. In Q3, earnings were not sufficient to make up for the decline in discount rates.

"Swiss corporate bonds have been extremely volatile for more than five years at below 1.0% - and below 0.5% in the last two years. They are currently hovering around 0% again," says Adam Casey, head of corporate retirement consulting at Willis Towers Watson in Zurich. While discount rates did briefly fall below 0% a few times, there has not been a prolonged period of negative discount rates. Given the level of current discount rates in Q3, it looks like the 0% level may soon be breached again. "Similar to a year ago, companies need to be prepared for discount rates to be negative at the end of calendar year 2020, according to IAS 19 valuations," he adds.

Negative discount rates mean that future liabilities are increased rather than discounted when calculating their value at today's terms. The potential impact on the financial statements is therefore an additional headache for companies, which are closely monitoring their liabilities due to the significant challenges they have faced so far this year.

Impact of a "second wave" on the market

Despite the second wave of the pandemic, which is already being clearly felt in many countries, the markets are remarkably resilient. It is true that returns were positive in Q3, averaging slightly below 2% for pension funds. However, overall levels have not yet returned to pre-crisis levels. Nevertheless, Michael Valentine, investment consultant at Willis Towers Watson in Zurich, believes that overall markets are neutral in price at best, but certainly not cheap given the economic impact of the corona crisis and the risks associated with what could be a very intense second wave. "Positive equity market valuations remain at the upper end of historical ranges as investors do not expect medium-term earnings potential to be impacted by the significant risks," he says. Central banks continue to take significant measures to support the economy, but the resulting huge increase in government debt also threatens market stability.

Asset allocation in uncertain times

The coronavirus pandemic is just one of many risks that pension funds should keep an eye on in their investments. Although this pandemic dominates our news, climate change and its economic impact have by no means become less important. "Sustainable investments that take into account, for example, climate change, broad societal issues and governance ("environmental, social and governance" - ESG) issues have often been seen as pure luxuries or as 'soft', non-financial investments that only have relevance in promising, dynamic markets. However, the current pandemic has caused many investors to rethink and take more seriously the potential financial impact of ESG factors on their portfolios," Michael Valentine points out.

| The market return of 1.9% percent in Q3, as measured by Pictet's 2005 LOB-40 plus index, satisfied companies with significant balance sheet positions. Corporate bonds fell back to their end-2019 levels, leading to an increase in pension liabilities of about 2.5%. Over the quarter, the impact of the increase in pension liabilities slightly outweighed the impact of positive investment returns. Nevertheless, the index remained positive at just over 100%. (Source: Willis Towers Watson)

|

| Background information on the study The Swiss Pension Finance Watch examines the impact of capital market developments on the financing of pension plans in Switzerland on a quarterly basis. The study is part of Willis Towers Watson's Global Pension Finance Watch, whose results for the world's major pension markets go back to the year 2000. The study results are published quarterly. The focus is on assets and liabilities. The study covers pension plans in Brazil, Canada, the eurozone, Switzerland, the United Kingdom and the United States of America. The impact of the capital markets on these pension plans relates to two areas

The Willis Towers Watson model is based on a benchmark pension plan that represents the pension obligations and plan assets (including asset mix) that typically occur in the respective pension market under consideration. A pension index is created based on the impact of capital market developments on the assets and obligations. This index reflects the changes in the funding level of the benchmark pension plan.

|