Risk management: Swiss companies show low risk appetite

A large majority of Swiss companies promote risk management and consider it important. However, companies pay too little attention to their risk appetite. These are the findings of a study by the Lucerne University of Applied Sciences and Arts and SwissERM on risk management in Swiss companies.

One third of the companies do not include these risk categories at all or only partially in the risk/opportunity analysis.

Effective risk management can neither influence nor predict the future. But it can help companies to anticipate and prepare for possible success-critical scenarios in good time. But to what extent do Swiss companies identify, manage and monitor their risks? To find answers to this question, the Institute for Financial Services Zug IFZ of the Lucerne University of Applied Sciences and Arts and the Swiss Enterprise Risk Management Association - SwissERM conducted the study "Enterprise Risk Management 2016". The results are based on the answers of 189 companies, which have more than 50 full-time employees and are active in a wide range of industries.

Political correctness, but...

The analysis shows that in more than three-quarters of the companies surveyed, management is explicitly committed to ethical and integrity (political correctness). "This so-called 'tone at the top' is the basis for successful risk management," says risk expert Stefan Hunziker of the Lucerne University of Applied Sciences and Arts. If the Board of Directors and Executive Management set an example and signal their commitment to ethical behaviour and integrity, they can raise risk awareness among employees.

However, many companies have some catching up to do in documenting their risk policy and their code of conduct and ethics. According to the study, only half of the companies do so.

Strategy development process

The biggest gap in the area of risk governance is in the targeted training of employees on ethical corporate values. Fewer than one-third of respondents say they use training as a tool. Companies also pay little attention to their risk appetite, i.e. their willingness to take risks.

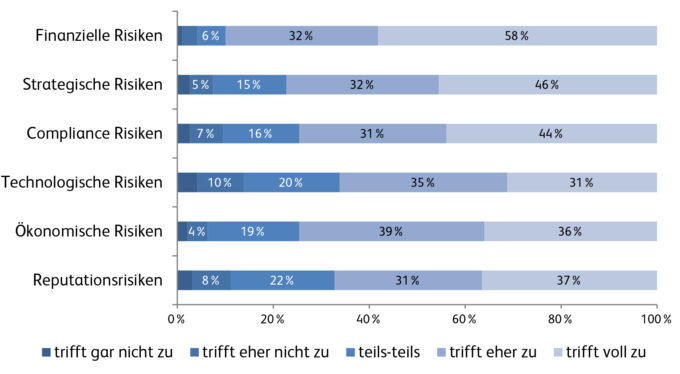

This area is only fully documented in a quarter of the companies surveyed. Just under one-fifth do not even record their own risk appetite (see figure in the appendix). Financial risks are the top priority for the majority of companies. 90 percent of the companies take them into account in the majority or completely when identifying risks. Strategic risks, on the other hand, are considered by only 78 percent. Reputation and technology risks or opportunities receive the least attention.

One third of the companies do not include these risk categories at all or only partially in the risk/opportunity analysis.

Conclusion: Potential is missing

On the basis of the results, those responsible for the study came to the conclusion that risk management has undoubtedly become a much-noticed topic in Swiss companies. "However, there is still a lot of untapped potential," says Stefan Hunziker, the study's director. "Risk management will only become a management tool that creates added value when companies consistently align themselves with strategic management, clearly define their willingness to take risks and repeatedly check its effectiveness".

The evaluation of the current status of risk management in Swiss companies is based on the draft "Enterprise Risk Management - Risk Management in Swiss Companies" published by COSO in 2016. Aligning Risk with Strategy and Performance" - under this Link