Commodity prices: Estimates for the next 12 months

How the prices of crude oil, refined products and natural gas will develop in the coming twelve months: An assessment by Max Holzer of Union Asset Management Holding AG.

What a roller coaster ride: In the past eight months, the price of a barrel of Brent crude oil initially almost doubled from around 70 to more than 130 U.S. dollars, only to drop again by 20 percent. The price is now around 120 U.S. dollars, but continues to fluctuate noticeably. This should not come as too much of a surprise. After all, the oil price is currently not only an expression of supply and demand, but also a plaything of geopolitical developments, driven by the war in Ukraine. It is caught between the high demand for energy and the declared desire to accelerate the move away from fossil fuels in order to limit climate change.

Commodity prices: Ukraine war causes crude oil prices in particular to rise

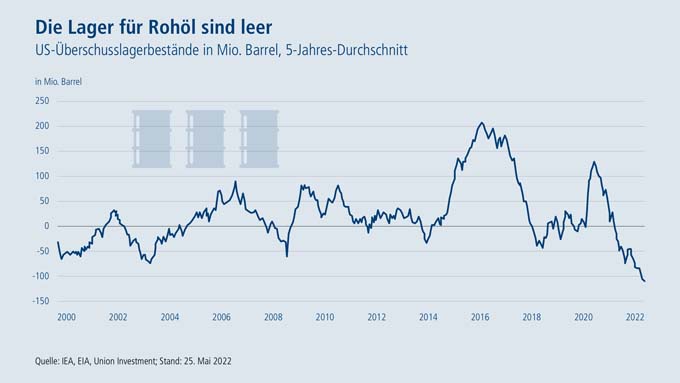

A review: The Corona pandemic had led to a significant drop in demand for crude oil and refined oil products worldwide. People drove fewer cars and flew on vacation less frequently or not at all. The mood in industry was also gloomy and energy demand was therefore significantly reduced. To keep prices stable, the Organization of Petroleum Exporting Countries (OPEC) reacted by countering low demand with low supply. It cut production. Then, as the pandemic slowly receded into the background and demand rose again, but production initially remained the same, the price of oil began a small spike. Stocks emptied. Then the war in Ukraine began and the oil price literally went through the roof. In addition to the already increased demand, uncertainty arose in view of the threat of supply stops and possible embargoes against the backdrop of empty inventories.

In addition, against the background of the sustainable transformation of the economy, the oil industry has not invested for a very long time. Renewable energies are expected to replace oil and gas in the long term. So why spend a lot of money to develop a new oil field? As a result, production capacity can no longer be ramped up without further ado. This has put oil companies in a comfortable situation. Costs are low because little has been invested, but cash flows are immense thanks to strong demand and high prices. No wonder shares in oil companies have done very well in recent months.

Nevertheless, what has happened in Ukraine and the consequences for the world market have made it clear that we are not yet ready for the oil exit. Shifts on the supply side can result in a significant price reaction. At least with regard to crude oil, however, it can be stated that the situation has calmed down somewhat. The release of strategic reserves by the U.S., for example, has eased the market, OPEC has adjusted production upward again, and Russian oil is finding alternative routes back into the world market. Instead of flowing westward as before, it is now flowing eastward to Asian buyers such as China and India. They are buying the oil at a substantial discount of around $35 per barrel. Basically, the supply situation is intact.

Against this background, the question arises: Why does the consumer feel so little of the improved supply? The answer is indeed difficult. Because the price of refined products has actually decoupled somewhat from the development of the oil price. The high cost at the pump is due not least to the fact that Russia is not only a major oil exporter, but also sells many oil products abroad. In addition to the 2.7 million barrels (casks) of crude oil that Russia exports to the EU, there are 2.3 million barrels of refined products, such as diesel or gasoline. And these products cannot be easily replaced because they are usually refined as close to the end consumer as possible. With some refineries also down as a result of the war, the remaining sites are operating at full capacity, and margins have climbed to record levels. For this reason, the reduction in the mineral oil tax will only help to ease the burden on consumers with a delay, if at all.

Vacation season additionally increases demand

The problem is that the situation is unlikely to improve much in the coming weeks. Millions of Europeans are looking forward to their summer vacation, and for many it will be the first real time off after the Corona years - and hardly anyone is going to take that away, not even for cost reasons. In addition, China is increasingly easing its Corona measures, so that more oil is likely to be needed again in the Middle Kingdom. This means increased demand, which is being met by low inventories, tight refinery capacities and limited supply. And because intermediate products are also affected by demand, the oil price should also remain at an elevated level in the coming months.

The good news is that the situation should gradually ease from late summer. This is because two effects can be expected: supply is steadily increasing, as OPEC and the USA are both expanding their production. At the same time, the expensive price of gasoline will hit consumers in the wallet, especially since measures such as the fuel rebate in Germany will then also be abolished. This means that demand is slowly declining. The whole thing happens at a time when, for seasonal reasons, less oil is needed anyway than, for example, at the height of summer - especially as many people are likely to fill their oil tanks earlier than usual this year for fear of supply shortages. The bottom line is that the price of oil should fall gradually. By the end of 2022, a barrel of Brent crude should cost around 95 US dollars. In twelve months' time, the price could then be around 80 US dollars - provided we do not see any further escalation in the Ukraine war, for example as a result of the involvement of other warring parties, and also no sudden increase in demand from China.

Gas price remains permanently at higher level

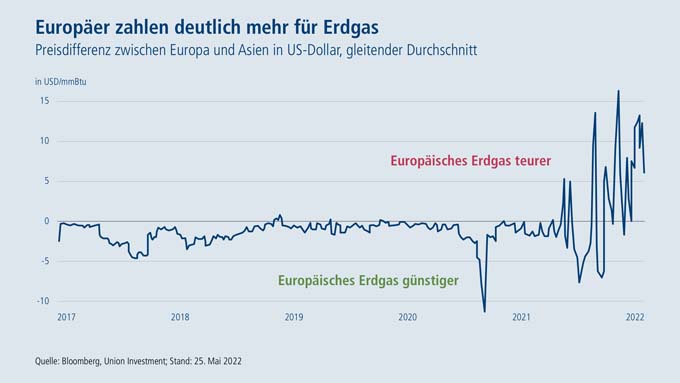

Unlike oil, we will have to get used to structurally higher prices for gas. Until now, Europeans have been in the comfortable situation of being supplied with cheap pipeline gas from Russia. But the Russian invasion of Ukraine changed everything. The risk of Europe's enormous dependence on Russia came to light and the issue of energy security moved to the top of the agenda for politicians, companies and private households. On the one hand, Russia could stop gas supplies at any time, plunging Europe's economy into a deep recession. On the other hand, gas exports are an important source of revenue for Russia, which is also used to finance its war of aggression. Until February, some countries had not seen the dependence as a problem. Now, however, there is acute pressure to act. One key: The large-scale - and in any case urgently needed in the fight against climate change - energy turnaround, which is becoming even more important as a result of current developments.

Until a nationwide and sufficient supply of green energy is within reach, Europeans will have to obtain their gas on the world market in the form of liquefied gas. In doing so, they are competing with Asian countries. This is clearly noticeable: Year-on-year, the price of gas has quadrupled. Until now, gas in Europe was usually somewhat cheaper than in Asia. Those days are likely to be over. In short, Europe has to pay a higher price than the Asian states to get its gas delivered. The truth is also that the Asian states are likely to generate their electricity by burning coal if demand from Europe means that gas is no longer affordable for them.

Rapid relief is hardly to be expected here. It will probably be several years before new sources, for example in Qatar, are developed. The construction of new plants and the development of new gas fields are also hampered by the political will to achieve an energy turnaround and say goodbye to fossil fuels. With regard to gas in particular, it is therefore necessary to grit our teeth and press ahead with the expansion of renewable energies in order to at least reduce the price by lowering demand.

Source: www.union-investment.de

Solidarity agreement for gas between Germany and Switzerland

Rising commodity prices are preoccupying politicians on many fronts. At the World Economic Forum (WEF) in Davos, for example, Federal Councilors Guy Parmelin and Simonetta Sommaruga met with German Vice Chancellor Robert Habeck. They decided to conclude a solidarity agreement on gas supply in crises. The aim of this agreement is "that we can support each other in an emergency," explained Federal Councillor Sommaruga.

Nothing has been signed yet. It is impossible to know how long it will take to reach the solidarity agreement, Sommaruga explained further. But the will for a pragmatic solution is there, she said. Currently, Switzerland is dependent on Russian gas for about 40 percent of its households, especially through supplies from Germany. The Federal Council further reiterated that it wants to build up alternative reserves in countries such as France, Germany and the Netherlands.

Germany, which is highly dependent on Russian gas, has just signed a partnership with Qatar. Part of that package includes being able to buy liquefied natural gas. "Swiss companies can apply to be involved in this," Habeck said about it at the WEF.

(red./SDA, Swissinfo)